|

|

|

|

March 2022

Keep up-to-date with us and what's happening in the business world

- 2022 Annual Accounts (EOFY): Questionnaires

- An Update on the COVID-19 Business Support Provisions

- Managing the impact of COVID-19 cases within your business: Schemes available

- Minimum Wage Increase ($21.20 per hour)

- Xero Tip of the Month - Setting up invoice reminders

- IRD Upcoming Tax Payment Dates

- Question of the Month: Is rollover relief available to transfer of trust property to a beneficiary?

- Client Spotlight: Bea DnD Games on Jackson Street, Petone

|

|

With the end of the financial year (1 April 2021 to 31 March 2022) just around the corner, now is the time to start pulling together those additional bits of information so that we can complete your 2022 annual accounts and tax returns.

As such, we have prepared our 2022 annual questionnaires in order to gather the essential information that we require to complete your financial accounts and assist us in ensuring that all your tax obligations are met. Therefore, we would appreciate it if you could please take the time to read through the questions and worksheets that are relevant for both your personal and business accounts.

For clients utilising Xero, we are likely to need the following key information:

- A list of stock on hand at 31 March 2022 (if over $10,000);

- Copies of loan statements at 31 March 2022;

- Copies of invoices for any large asset purchases (IE: new vehicles, etc.); and

- Completion of the Use of Home Office template or list home office expenses.

We will require additional information detailed on the Non-Xero questionnaire for clients not utilizing Xero.

The questionnaires can be accessed via our website by clicking the button below but for clients that would prefer to wait, we will be sending out questionnaires specific to your business over coming week. Once you have

gathered and collected all required information to attach, please email your completed questionnaires through to the team at advice@aafl.nz.

If you require any assistance, or have any questions around the above points or the questionnaires, please do not hesitate to give us a call on 04-970-1182.

|

|

We bring to you an update on the COVID-19 Support Payment (CSP) changes & SBCS application date due to the COVID-19 Omnicron impacts.

The Second COVID-19 Support payment (CSP)

Applications are now open for the second COVID-19 Support Payment (CSP), with a third payment opening on 28 March 2022. The period each CSP will cover are:

The period each CSP will cover are:

• For the 1st CSP, businesses will need to show their income is 40% lower in a 7-day period any time between 16 February 2022 and 4 April 2022, compared to a typical week between 5 January and 15 February in either 2021 or 2022.

• For the 2nd CSP, businesses will need to show their income is 40% lower in a 7-day period any time between 7 March 2022 and 4 April 2022, compared to a typical week between 5 January and 15 February in either 2021 or 2022.

• For the 3rd CSP, businesses will need to show their income is 40% lower in a 7-day period any time between 21 March 2022 and 4 April 2022, compared to a typical week between 5 January and 15 February in either 2021 or 2022.

Businesses can also now compare their income drop to a typical week between 5 January to 15 February 2021.

Self-employed people who have received the Ministry of Culture and Heritage’s one-off emergency grant for self-employed people will be able to apply for the 2nd and 3rd CSPs.

Please note that all applications for all 3 CSPs will close on Thursday, 5 May 2022.

For further information, click the button below.

The Small Business Cashflow Scheme 'top up' loan :

The Small Business Cashflow Scheme (SBCS) loan amount has now increased to $20,000 (from $10,000), plus $1,800 per full-time equivalent employee.

For more information, click the button below.

|

|

As we are now in phase three of the omicron variant, it's essential to plan ahead for how your business will continue to operate if you or your workers get sick or have to isolate because of COVID-19; doing so will protect your workplace, workers, and community.

Here is the latest information to guide you through the Bubble of One and Close Contact Exemption schemes:

THE BUBBLE OF ONE SCHEME:

The Bubble of One scheme is available if you have a worker who is a close contact but is not customer facing and can maintain a 'bubble of one' while at work, meeting all detailed criteria.

To work under a bubble of 1, workers must:

- be fully vaccinated

- not have COVID-19 symptoms (asymptomatic)

- not have contact with anyone else at work (whether indoors or outdoors).

You do not need to use rapid antigen tests to return to work, and businesses will not need to register for the ‘bubble of 1’.

At work, the ministry of health measures must be in place. Businesses must have systems and processes in place to support these, and the worker must comply with them.

For more information on the Bubble of One Scheme, click the button below.

CLOSE CONTACT EXEMPTION SCHEME:

The Close Contact Scheme is available for critical workers who have been identified as a household contact and are asymptomatic and vaccinated. The scheme allows the continuation of work, as long as they return a negative rapid antigen test prior to each day/shift during the isolation period and follow specific health protocols. Close Contacts are not eligible for the scheme, as they are no longer required to isolate.

Critical workers participating in the scheme will only be allowed to go to and from work or collect their free Rapid Antigen Test kits from their closest collection site. They must otherwise stay in their place of self-isolation.

At work, the ministry of health measures must be in place. Businesses must have systems and processes in place to support these, and the worker must comply with them.

For more information on the Close Contact Exemption Scheme, click the button below.

|

|

MINIMUM WAGE INCREASE ($21.20 PER HOUR)

From Friday, 1 April 2022, the minimum wage will be increasing.

Details of the changes are:

- The adult minimum wage will increase from $20.00 to $21.20 per hour.

- The minimum wage for starting-out and training will go up from $16.00 to $16.96 per hour.

- All rates are before tax and any lawful deductions, for example, PAYE tax, student loan repayment, child support.

If this change affects you and your business, now is the time to talk this through with us.

As a reminder, there are 3 types of minimum wage : adult, starting-out and training.

The adult minimum wage - applies to employees aged 16 years or older.

The starting out minimum wage - applies to workers who are:

- 16 and 17 years old and have been with their current employer for less than 6 months

- 18 or 19 years old - have been paid a benefit for 6 months or more, hasn’t worked for 1 employer for longer than 6 months since being on a benefit, and have been with their current employer for less than 6 months

- 16 to 19-year-olds whose employment agreement requires them to do at least 40 credits a year of industry training.

The training minimum wage - applies to workers who:

- are 20 years or older

- under their employment agreement, have to do at least 60 credits a year of industry training.

If you would like to know how we can help your business forecast for the year ahead and create a realistic budget to account for this minimum wage rise and other factors you might need to consider in the upcoming year, get in touch with us today.

To find out more on the minimum wage 2022, click the button below.

|

|

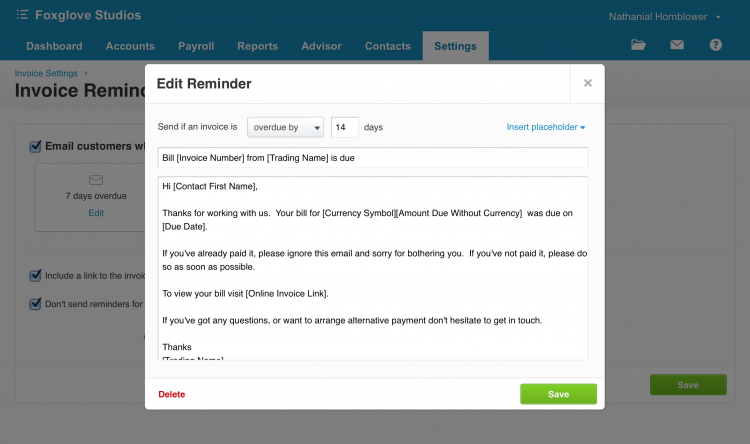

XERO TIP OF THE MONTH - SETTING UP INVOICE REMINDERS

Need to follow up on your accounts receivable but don't have the time? Let Xero take care of it for you with the automatic invoice reminder feature! You can set up invoice reminders, configuring Xero to automatically send customer reminders based on how far an invoice is past due.

To set this up:

- Go to Settings, then General Settings, then Invoice Settings, where you’ll see the Invoice Reminders button. Here you can turn on invoice reminders.

- Choose from the predetermined days' past due parameters or create your own reminder. You can even customize what each reminder email says by clicking on the Edit link.

Additionally, Xero has an option to include a link to the invoice in the reminder email as well as an option to not send reminders for outstanding invoices under a certain amount. If you need to get even more specific, you can turn off reminders for a particular customer or invoice.

|

|

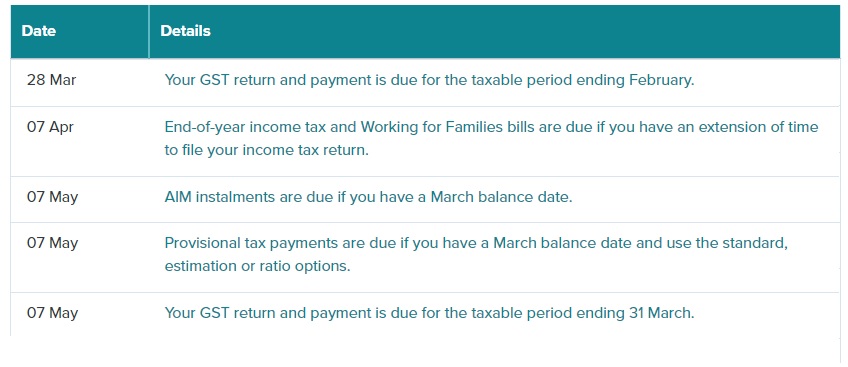

IRD UPCOMING TAX PAYMENT DATES

|

|

QUESTION OF THE MONTH:

QUESTION:

A trust owns a rental property. The settlor has passed away and left a memorandum of wishes, resulting in the transfer of the rental property to a trust beneficiary. Assuming the property is transferred at market value, there will be depreciation recovered. Is there any exemption for the trust in respect to transferring this rental property under what is essentially an inheritance?

ANSWER:

A distribution of property by a trustee to a beneficiary is deemed to take place at market value.

Sections FC 1 and FC 2 Income Tax Act 2017 also apply a market value consideration to:

- the transfer of a person’s estate to an executor or administrator on the death of the person:

- the transfer of property on a distribution by an executor, administrator, or trustee of a deceased person’s estate to a beneficiary who is beneficially entitled to receive the property under the will or the rules governing intestacy.

Transfers under a will (either from the deceased to the estate or from the estate to a beneficiary of the will) may be subject to rollover relief (which effectively allows for a non-market value consideration on the transfer). Rollover relief does not, however, extend to a distribution by a trustee to a beneficiary.

In this case, the transfer is not from the estate to a beneficiary under a will, but from a trust to the beneficiary because of the memorandum of wishes. There are no exemptions from the deemed market value consideration in these circumstances.

Therefore, if the consideration (being market value) is greater than the item's adjusted tax value on the date of disposal, the trust will have depreciation recovery income from the transaction.

|

|

CLIENT SPOTLIGHT: BEA DND GAMES ON JACKSON STREET, PETONE

All Accounted For is proud to introduce Bea DnD Games, a quirky, fun, and family-owned local Wellington games store located at 199 Jackson Street Petone.

With a great vibe and an extensive range of games, from family favourites all the way through to role-playing games, you can bring your gaming hobby to life with Bea DnD games!

Pop into store to say hello and have a chat with one of the friendly staff members, get hobby advice and recommendations, or head on over to their website by clicking the button below, where you can shop online.