|

|

|

|

February 2022

Keep up-to-date with us and what's happening in the business world

- COVID-19: New financial support for businesses affected by Omicron

- COVID-19: Existing Workplace Support Schemes

- Fringe Benefit Tax (FBT) : A brief overview

- Xero Tip of the Month - Create repeating invoices and bills

- Question of the Month: Is the sale of bonds by a trader taxable under the financial arrangement rules?

- Client Spotlight: Gerry's Charcoal Chicken

|

|

In light of the Government's announcement on Tuesday, 21 February 2021, New Zealand has now moved into Phase 3 of its Omicron Response. As such, there is new additional business support available. Here's what you need to know:

New targeted COVID-19 Support Payment: Applications now open

The COVID-19 Support Payment (CSP) is available for businesses struggling with revenue during the Omicron outbreak with the first of the three payments now open from today, Monday, 28 February 2022, for the period starting from 16 February 2022.

A further amendment to the scheme has since been announced today, Monday, 28 February 2022, which will allow non-eligible businesses who have experienced a drop in revenue before this period to compare their income to the same period in 2021.

Criteria:

- Each payment will be $4,000 per business plus $400 per full-time employee, capped at 50 FTEs or $24,000, this is the same rate as the most recent Transition Payment.

- To be eligible, businesses must have experienced a 40% or more drop in revenue in a 7 day period from 16 February 2022 compared to a typical 7 day period between 5 January 2022 and 15 February 2022. However, as a number of businesses have already experienced a drop in revenue before this period and cannot show the 40% drop, the Minister of Finance has announced today (Monday, 28 February 2022) that these businesses will also be able to compare their income to the same period in 2021. This option is not yet available, but we will let you know as soon as it is.

- Applications for the first payment are open from today, Monday 28 February 2022, with payments starting from 1 March. It will be available on a fortnightly basis for 6 weeks, with 3 payments in total.

If you have questions, require any assistance or would like us to complete the applications, please get in touch with us today.

Covid-19 Small Business Cashflow Loans Scheme:

Changes have also been made to the Small Business Cashflow Loans Scheme to increase the amount of funding available to eligible businesses through the introduction of a ‘top up’ loan. The top-up loan will allow businesses that have already accessed a loan to draw down an additional $10,000 with a new repayment period of five years and the first two years being interest-free.

These changes will be made to the SBCS by the end of March, more information will be available soon.

|

|

COVID-19 EXISTING WORKPLACE SUPPORT SCHEMES

Covid-19 Short-Term Absence Payment:

The COVID-19 Short-Term Absence Payment is available for businesses, including self-employed people, to help pay their employees who cannot work from home while they wait for the results of a COVID-19 test.

The Short-Term Absence Payment is available to help businesses keep paying eligible employees who:

-

cannot work from home, and

-

need to miss work to stay home while waiting for a COVID-19 test result (in line with public health guidance).

There is a one-off payment of $359 for each eligible worker. You can only apply for it once, for each eligible employee, in any 30-day period (unless a health official or doctor tells the employee to get another test). The Short-Term Absence Payment is also available to self-employed people. To find out more about the Short-Term Absence Payment on the Work and Income Website below.

Covid-19 Leave Support Scheme Payment:

The COVID-19 leave Support Scheme is available to employers, including self-employed people, to help pay their employees who have been advised to self-isolate because of COVID-19 and can't work at home during that period.

This means your employees:

-

can't come into work because they are in one of the affected groups and have been told to self-isolate, and

- can't work from home

The COVID-19 Leave Support Scheme is paid at the rate of:

-

$600 a week for full-time workers who were working 20 hours or more a week.

-

$359 a week for part-time workers who were working less than 20 hours a week.

To be eligible for a one-week payment of the Leave Support Scheme your employee will have been advised to self-isolate for at least four consecutive calendar days (and be unable to work from home for that period). To find out more about the COVID-19 Leave Support Scheme on the Work and Income website below.

We're here to help

We can assist with the preparation of your applications, along with offering any business advice and the support required to get you through this challenging period as we enter the next phase of Omicron. If you have any questions or need any assistance, please give us a call.

|

|

Do you offer fringe benefits to your employees?

While we understand that Fringe Benefit Tax (FBT) can, at times, be overwhelming, it's essential to get it right, which is why we've put together a brief overview below to ensure that employers meet their FBT requirements in order to avoid late payment penalties and interest. 31 May 2022 is the due date for the next quarterly FBT return and also for those that file FBT returns.

What is fringe benefits tax?

Fringe Benefit Tax (FBT), is a taxable non-cash benefit provided and enjoyed by an employee as a result of their employment relationship that is in addition to wages or salary. As an employer you may be liable for tax (FBT) on certain benefits provided to employees. The most common are:

- Motor vehicles provided by the business for the employee's private use

- Free, subsidized or discounted goods and services

- Low-interest loans

- Employer contributions to sickness, accident or death benefit funds, superannuation schemes

When to file your FBT return:

As an employer you are required to file your FBT return either quarterly, annually or by income year. Your choice will depend on the type of company you manage, whether you were an employer in the previous year, the benefits you provide and how much tax you pay.

FBT Calculation Methods:

There are three different types of FBT rates; singe rate, short-form alternate rate, and full alternate rate.

If you file an annual return, you can choose any of the three FBT rates and change rates from year-to-year. If you file quarterly, you can swap between FBT rates during the year. However, if you elect and pay FBT using the alternate rate in any of the first three quarters, you must complete the alternate rate calculation process in the fourth and final quarter.

For more in-depth information on how to calculate your fringe tax liability, please refer to the formulas provided by IRD in their FBT guide which can be found by clicking the button below.

|

|

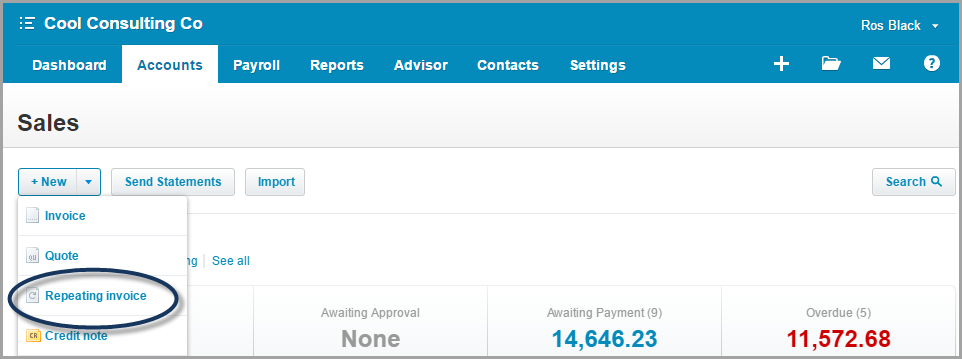

XERO TIP OF THE MONTH - CREATE REPEATING INVOICES AND BILLS

Do you have invoices you create and send regularly? Want to save yourself the time and trouble of having to repeat the same process again and again?

Utilize Xero's repeating invoice function by developing a template and Xero will automatically create an invoice or bill for you based on the frequency you specify. Xero will put it in the Draft tab if you need to vary the amount (or another field), and if everything is the same each time, it will go in the Awaiting Payment tab.

Again, this feature can be set up for both invoices and bills and is done by accessing the Repeating tab in each respective category. From there, click “New Repeating Invoice/Bill” and you’ll be able to create a new template or use an existing one, and set up the specifications you require.

|

|

QUESTION OF THE MONTH:

QUESTION:

An individual has a share trading business, which includes bond trading. He is now selling the bonds above cost price. How is the sale of bonds treated for a trader? Is the capital gain taxable and if there was a loss, would this be tax deductible?

ANSWER:

The sale of the bonds is subject to the financial arrangement rules, regardless of whether the individual is a trader.

When a person ceases to be a party to the financial arrangement, a base price adjustment ("BPA") is required. The BPA is a wash-up calculation intended to identify any income or expenditure under the financial arrangement that has not already been returned by the taxpayer.

The BPA formula is: consideration − income + expenditure + amount remitted

Where:

- "consideration" is all consideration that has been paid, and all consideration that is or will be payable, to the person for or under the financial arrangement, minus all consideration that has been paid, and all consideration that is or will be payable, by the person for or under the financial arrangement.

- "income" is income derived by the person under the financial arrangement in earlier income years

- "expenditure" is expenditure incurred by the person under the financial arrangement in earlier income years.

- "amount remitted" is an amount (a remission) that is not included in the consideration paid or payable to the person because it has been remitted by the person or by law but excluding a self-remission.

If the amount of the BPA is positive (for example, due to a gain on sale as is the case here), the positive amount is assessable income.

If the BPA amount is negative (for example, due to a loss on sale), a deduction can be taken to the extent it is incurred in deriving income or carrying in a business to derive income. As the trader is in the business of dealing in bonds, a deduction for a loss will likely be claimable. If the loss is not fully deductible under the general permission (for example, if the individual was not a trader) a deduction can be claimed to the extent of income that has previously been returned under the financial arrangement.

Therefore, if the individual sells the bonds at a profit it is likely a positive BPA will result, giving rise to assessable income.

|

|

CLIENT SPOTLIGHT: GERRY'S CHARCOAL CHICKEN

At All Accounted For, we have the privilege of working with a diverse range of clients - whether you are in the hospitality industry, building to property; we are always proud to shine a light on the clients we work with, showcasing their products and services.

This month, as our first client spotlight of 2022, we are delighted to introduce our new client, Gerry's Charcoal Chicken.

Based in the Upper Hutt, Gerry's Charcoal Chicken is in a league of its own, offering the most scrumptious, charcoal-grilled chicken along with a range of tasty desserts. Well worth the drive and highly recommended on Google with a whopping 4.7-star rating!

We look forward to working closely with Charlotte and Steven, the proud new owners of Gerry's Charcoal Chicken.