|

|

|

|

January 2022

Keep up-to-date with us and what's happening in the business world

- COVID-19 Red Light Setting Protection Framework: Contacting the AAF Team

- Welcome 2022: Helping You Reach Your Financial & Business Goals

- Short-stay Accommodation : Tax guidance for Airbnb hosts

- IRD Upcoming Tax Payment Dates

- Xero Tip of the Month - Setting different user roles

- Question of the Month: Is interest deductible on funds borrowed to pay a capital distribution?

- New Premises Update

|

|

In response to the move to the Governments COVID-19 Red Light Setting Protection Framework effective 11.59 pm on 23 January 2022, we have split our Wellington team into two to protect our team, their families and to ensure we can continue to provide services to our clients in the event of an outbreak of COVID. The teams will be taking turns, week-on week-off in the office, working remotely during their weeks out of the office. As a result of splitting the team, your access to the team will operate slightly differently in the meantime:

If you need to reach us by phone, please continue to call through as usual (04-970-1182), and if the respective team member isn't in the office, you will either be connected to their mobile phone, or we'll take a message, and they will get back to you. While we appreciate that this is not ideal, we ask for your understanding and support as we work to keep everyone as safe as possible and to continue providing services to meet your business needs.

As the community outbreak of Omicron develops, we will review this approach and keep you posted on any updates within the office. If you have any questions or concerns, please feel free to give Ben Duflou (021 915 233) or Sarah Toner (021 400 622) a call, to discuss. Take care, and ensure you look after the family and yourself through this next phase of the COVID pandemic.

|

|

The beginning of a new calendar year is an excellent time to review the year just finished and reflect on what worked, what didn't, what you'd like to change and new things you'd like to implement.

Take the time to review the year and acknowledge all that has happened, good, bad or indifferent. Examining the year with an objective perspective can provide valuable insights to prepare for the next business year. Planning and goal setting will help provide a focus for your business efforts.

Your Yearly Business Review

- What were the most significant impacts on your business in 2021? How well did you meet the challenges?

- What worked well last year? What systems, technology, products or services were successful?

- What accomplishments can you celebrate?

- What situation, event or experience provided the biggest learning opportunity?

- What is the biggest challenge you face as you prepare for 2022?

- Analyse your financial reports. Are you earning what you'd like to? Is the business sustainably profitable?

We can help:

While there are many metrics you could evaluate to track business performance, we've given you just a few ideas to inspire your business planning for 2022.

We can help you thrive again by implementing a tailored business plan. Whether it's working through a financial model, providing support to execute your plans or helping to identify your advantages - together, we can do it!

Conducting a past-year review with one of our experienced advisors will provide valuable insights for this year's goal setting. Our expert team will run through your current business plan, provide feedback on where you're heading and talk through the opportunities you might not see in your own business.

Keen to learn more? We offer many business advisory services, including:

- Business Reporting: monthly, bi-monthly, or quarterly

- Cash Flow Forecasting

- Budgeting

- Business Valuations

- Software Systems & Apps: setups and assistance

Let's catch up to talk through your business plan today. Give Ben Duflou or Sarah Toner (04-970-1182) a call to discuss how we can help.

|

|

SHORT-STAY ACCOMODATION: TAX GUIDANCE FOR AIRBNB HOSTS

Airbnb can be an excellent way to bring in those extra bucks - especially over the holiday season! You might list your home when you travel, rent out a private room or even operate a second property as a vacation rental on Airbnb. However, it's important to remember that there's more to it than just putting your property out there; running an Airbnb is a business venture, so tax obligations come with renting out your home.

Any income you receive for providing accommodation, including through websites like Airbnb or Bookabach, is taxable; this includes any payment for one-off or irregular rentals. Special tax rules apply to calculating income and expenditure from short-term rental accommodation (also known as short-stay accommodation) depending on the property type and its use.

This means you:

- must include the income on an Individual tax return (IR3). This can be filed online via your myIR account - for most people its due 7 July.

- can claim expenses for the time you rented out the property/space, (see claimable expenses below)

- must keep clear records to confirm all income and expenses.

GST rules also apply if your income is over $60K in a 12-month period. GST might also apply if you offer guests meals, cleaners or other services in addition to the accommodation.

Claimable Expenses:

You can claim tax deductions for all expenses which are incurred in deriving your rental income. Typically, where the entire property is rented out, all of the costs involved in running the property will be deductible. Where you rent out part of a property you're living in, expenses are split based on floor area and usage.

Expenses fall into three categories:

- Expenses directly associated with the rented area can be deducted in full

- Expenses related to shared areas need to be apportioned

- Expenses related to the host's private area only cannot be deducted.

Expenses that may be deductible include:

- Depreciation of chattels within the rented space

- Commercial cleaning of the rented area / laundry costs

- Repairs and maintenance

- Rates

- Water Rates

- Insurance

- Interest

- Food, such as breakfast provisions, made available to the guest

- Professional photography for the listing

- Amenities such as electricity, gas, heating, Sky/Netflix, internet and security

- Service fees and commissions charged by Airbnb.

- Soaps, detergents, tea, coffee, toilet paper and other consumables

TOP TIP:

Keep your records in good order:

Need a hand in doing so? Give us a shout and we'll get one of our expert book keepers on the case!

Special Tax Rules:

Inland Revenue has several publications on short-stay accommodation to help you work out which rules apply depending on the type of property and use, e.g., the "standard rules" or "mixed-use asset rules" (discussed in the short-stay accommodation guide). To access this guide, click the button below, where you will be directed to the IRD short stay accommodation overview document containing a flow chart to work through which rules apply to your type of property and its use.

Feeling overwhelmed by Airbnb Taxes? Unsure which rules apply to your circumstance?

While the overview above should help you grasp the different tax obligations your Airbnb will be subject to; you may have some questions specific to your property and how it is used. We can help take the stress out of short-term rental ownership. We'll look at the big picture of your taxes and help you take proactive steps to reduce your tax burden where possible while ensuring your record-keeping practices keep you in compliance. Give our team of friendly experts a call today!

|

|

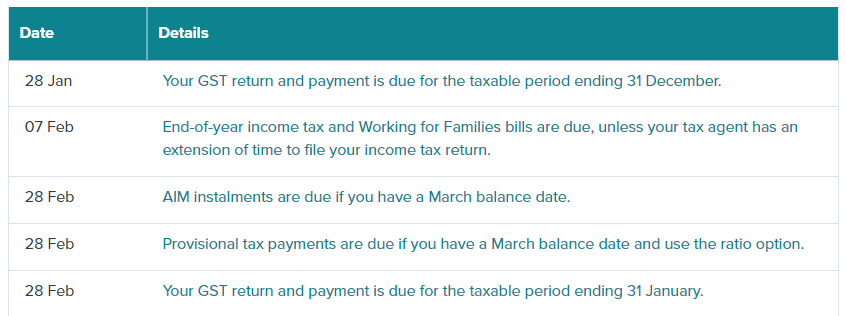

IRD UPCOMING TAX PAYMENT DATES

|

|

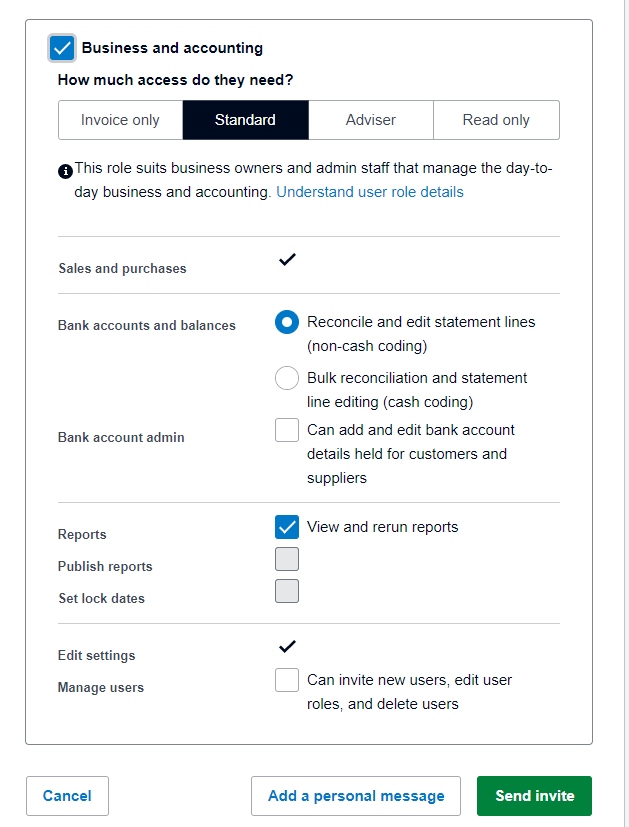

XERO TIP OF THE MONTH - SETTING DIFFERENT USER ROLES

By creating customized roles for each Xero user, you can give staff access to certain parts of your Xero file. So, you don't need to show everything to everyone.

To set a user's role when you add them to your Xero organization, do the following:

1. Click on the Settings tab, then select General Settings.

2. Click the Users link, then click Invite a User

3. On the next screen, you will see options ranging from Advisor (which is the role you want to assign to us as your Chartered Accountant, to none). There are six different options

So, if you have a team member responsible for invoicing, then just give them invoice only mode. They might not need to see your full Profit & Loss report.

At the bottom of this screen, you'll see a link to "Understand user role details". This takes you to a page that fully explains what each role can access; no more confusion when choosing the correct options for a new user.

|

|

QUESTION OF THE MONTH:

QUESTION: The trustees of a trust wish to make capital distributions to the trust’s beneficiaries.

The trust owns residential and commercial properties from which it derives rental income. The trust has capital reserves arising from sales of properties that have been reinvested to acquire its existing properties. There are significant unrealised capital gains in relation to the existing properties.

To make the capital distributions the trustees intend to borrow against the properties and use the borrowed funds to pay out capital distributions to the beneficiaries.

If the trustees borrow funds to pay capital distributions to the beneficiaries, will the interest incurred on those borrowings be tax deductible?

ANSWER: The interest will be deductible under the general permission (s DA 1 of the Income Tax Act 2007) if the trustees incurred the interest:

in deriving assessable income and/or excluded income; or

in the course of carrying on a business for the purpose of deriving assessable income and/or excluded income.

Interest on funds borrowed to pay a capital distribution to beneficiaries is not incurred in deriving income.

Whether or not the trust's rental activity amounts to a business is not clear from the background but, even if it amounted to a business, it seems unlikely that interest on funds borrowed to make a capital distribution to beneficiaries would be considered as incurred in the course of carrying on the business.

Interest deductibility might arise if the trustees were borrowing funds to repay amounts advanced to the trust by the beneficiaries.

Interest might also be deductible if the funds were borrowed to avert the trustees from the need to sell income-earning assets. Importantly, the liability that gave rise to the borrowing would have to have been incurred involuntarily. By contrast, in this case the liability is entirely voluntary; it arises from the trustees exercising their discretion to make a capital distribution to beneficiaries.

In summary, the interest on funds borrowed by the trustees to make a capital distribution to beneficiaries is unlikely to satisfy the general permission and, therefore, is unlikely to be deductible.

|

|

NEW PREMISES UPDATE: DEMOLITION COMPLETE!

Renovations are finally underway, with demolition now complete! The old walls have been knocked down to make way for the new layout, so things will soon be taking shape!

Our fantastic Practice Manager, Kerrin, has recently created a detailed 3D Floorplan, allowing us to view design elements before construction begins!

It won't be long before this space is transformed into our new premises to accommodate our hardworking team and valued clients. We can't wait for you to see the finished result! Stay tuned; we will have some more updates soon!