For year ending 31 March 2022

Below is a checklist of matters relevant to all business entities which you should consider, some of which may help you reduce the amount of tax you have to pay for 2021 year.

1. Provisional Tax Elections and Use of Money Interest and the 39% top tax rate

If provisional tax has been paid on the basis that you will be a provisional taxpayer for the 2022 year, but it subsequently transpires that this is not the case (because residual tax is below $5,000), an election to be a provisional tax payer for the year is required in order to receive use of money interest on provisional tax overpaid.

In case your financial circumstances change or expect your current provisional tax is overstated compared to your actual terminal tax liability for the 2022 financial year, please contact our accountants so we can schedule your annual accounts to be completed before the 7th May 2022 (final provisional date).

Please, note that from 1 April 2021, the top tax rate of 39% is imposed on income exceeding $180,000.

2. Bad Debts

In order to claim a tax deduction for trade related bad debts, the debt must be physically written off in the accounting records before balance date. If a debt is ‘bad’ there must be no reasonable expectation of recovery. However, this does not mean taxpayers can no longer pursue recovery of that debt. You will need to let us know if you and the debtor are associated.

3. Donations

Companies are entitled to a deduction for donations made to approved donee/charitable organisations only limited by the amount of company’s net income for the year. If you made a donation as a natural person, you will be entitled to 33% donation rebate. Please, send us copies of donation receipts for the rebate claims

4. Fixed Assets and Depreciation

Assets purchased for less than $1,000 can be expensed. Depreciation can be claimed from the first day of the month of purchase. However, if fixed asset is sold during the year, depreciation is disallowed for the full year regardless of when the asset was disposed. To maximise the depreciation expense and minimise tax from depreciation recovery, please consider deferring the sale until after 31 March.

You should conduct a review over the fixed asset register in the prior year financial statements and ensure all assets listed in the register are up to date.

5.Prepaid Expenditure

The Income Tax Act applies the principles of accrual accounting to the unexpired portion of deductible expenditure at the end of an income year. The effect is to defer the deduction of any unexpired amounts to the following income year.

Some expenses can be prepaid regardless of the amount or period being prepaid, for example:

- Stationery,

- Subscriptions for papers or journals,

- Vehicle registration and road user charges,

- Postage and courier charges,

- Rates,

- Audit and Accounting fees,

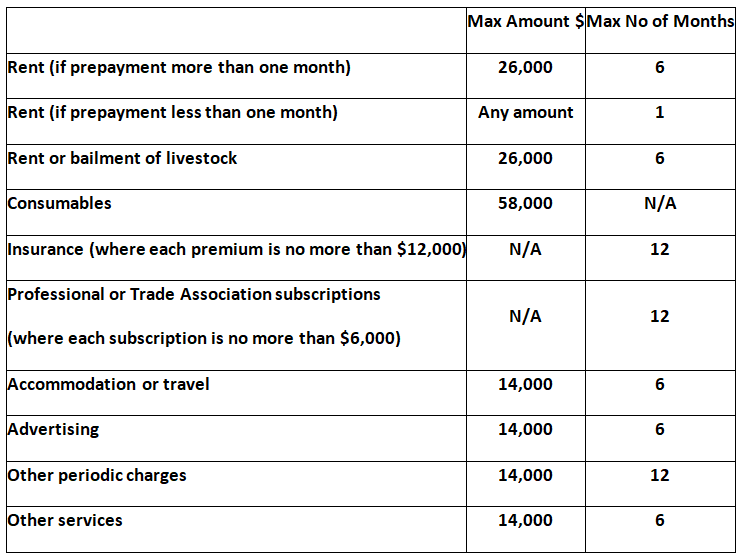

Other expenses can be paid in advance only up to a certain limit, for example:

The legislation regarding allowable prepayments is complex and we recommend clients discuss with us any plans for prepaying expenses prior to committing to any expense.

Prepaid expenditure on items other than those covered above is only tax deductible to the extent the services have been performed or goods provided. Therefore, a payment for repairs made before balance date will generally not be tax deductible unless the repairs have actually been carried out.

6. Repairs & Maintenance

Generally, no deductions are allowed for a repairs and maintenance reserve. It may be worthwhile undertaking repairs and maintenance prior to 31 March 2022 to obtain a full deduction. Deciding on the nature of the expenses (revenue or capital) is often a difficult decision. Please contact us if you require any assistance in this area.

One year warranty purchased with a fixed asset can be deducted as an expense rather than capitalised. However, if you purchased a warranty that is longer than a year, this will need to be capitalised.

7. Trading Stock

The closing stock value affects the profit or loss of the business. Higher closing stock values result in higher profits whereas lower closing stock value results in lower profits, thus affecting the taxation figure as well. The closing stock value must be true and fair as per IRD’s requirements.

For businesses with turnover of less than $1.3m, you can value closing stock the same as opening stock if closing stock can reasonably be estimated at less than $10,000. You may be able to use the market value for the closing stock if this is lower than cost. Please, also ensure you take into account for any obsolete stock or stock that is stolen or disposed of for any reason.

8. Shareholding Continuity

Any change in shareholding during the financial year has implications on one or more areas for taxation purposes. These include Imputation credit accounts, losses to carry forward, Qualifying company/Look Through Company status, loss attributions, shareholder salaries, etc.

Shareholding continuity must be maintained in relation to the carry forward and grouping of losses. 49% continuity must be maintained in the loss company from the time the loss is incurred until the time the loss is utilised. The loss, however, can be carried forward if the main business activity is the essentially the same although the shareholder continuity is breached under the new business continuity test.

For grouping, commonality of 66% is required. That is, the same group of persons must own 66% in both companies at all times during the continuity period.

To rely on the wholly owned group exemptions, 100% common shareholding must be maintained throughout the year.

In order to retain the company ICA balance, 66% shareholding continuity must be maintained throughout the year.

Please consult with one of our accountants first if you intend to and/or are expecting any change in shareholding in the company.

9. Subvention Payments & Loss Offsets

You should ensure that any prior year group loss offsets and subvention payments are completed and lodged with the IRD prior to year-end. Loss offsets and subvention payments relating to the year ending 31 March 2022 are due on or before 31 March 2023.

10. Qualifying Companies (QC)

For existing QC clients, you need to consider whether it is still appropriate to remain in the regime for various reasons. If you wish to revoke the status by intent you have till end of the year (i.e. by 31 March 2022) to revoke election for that year. It is also important to check number of events (i.e. change in shareholding, change in trustees of trust, dividends paid to trust shareholder not passed out to beneficiaries etc.) to ensure there are no deemed revocation.

11. Look Through Companies (LTC)

If you wish to elect the company to be LTC, you need to elect by 31 March 2022 to become effective from 01 April 2022. Any new companies (including shelf companies if non-active declaration filed) have exceptions whereby they have until the first tax return due date to be filed to make the election. There are various reasons as to why you would want to elect company to be LTC (i.e. if you are planning on restructuring company assets for asset protection purposes etc.). However, there are other factors to consider as well such as LTC entry cost arising from not having enough imputation credits for retained earnings and existing associated person gains.

The benefits of having LTC are now limited for rental property investors for rental losses being ring-fenced and not able to offset income from other sources.

12. Transitional Resident Exemption

This rule applies to individuals who are becoming new residents or residents returning to NZ after 10 years absence from 01 April 2006 for those arriving on/after that date. It allows exemption on all foreign sourced income from tax other than employment and services income derived while NZ resident for 48-month period. There are times when you are better off to elect out of this exemption (i.e. if offshore losses exist with NZ income) so it is prudent to discuss this with us should you fall under this exemption.

13. Company Advances

If you have a company and the company has advanced the funds that result in an overdrawn shareholder current account, loan to associated entities (where not 100% commonly owned), associated trust, staff, shareholder-employee/associated person, shareholder then it may trigger tax implications. There are ways to deal with any potential tax implications (salary, dividend or restructuring debt) which can be discussed.

14. Imputation Credit Account (ICA)

Please check your imputation credit balance to ensure that it is either a nil or credit balance at year end. If the ICA is in debit balance this will create a 10% imputation penalty which is not treated as a “tax payment” for income tax purposes.

15. Dividend Resident Withholding Tax (DWT)

If dividends declared and /or paid during the year have been imputed at 28% the DWT return and a payment of 5% will need to be filed and paid to IRD by 20th April 2022. Therefore, please advise us if the dividend has been declared and imputed at 28% and forward us dividend statement in order to fully impute the dividends.

16. Accruals

Make a list of all expenses that you owe at balance date i.e. 31 March 2022. These can be claimed as a deduction in the 31 March 2022 income tax return.

17. Home Office Expense

If you have an office in your home, you may be able to claim a portion of all expenses that relate to all your home expenses. The details of expenses that may be claimed are noted in the enclosed questionnaire or please contact one of our accountants for an excel template that you can use to summarise your home office expenses.

During the 2018 tax year IRD introduced an alternative method for calculating home office called the square meter rate option and is calculated based on a rate set by the Inland Revenue Department.

18.Legal Expenses

For the 2010 income year and beyond, legal expenses incurred when buying capital assets used to derive taxable income are tax deductible, provided total legal expenses for an income year are equal to or less than $10,000.

19. Business Expenses Paid Personally

All business expenses which have been paid personally and did not go through the business books or bank account can still be claimed as a business expense for taxation purposes. Please provide lists of such expenses.

20. Fringe Benefit Tax (FBT)

If certain benefits (e.g. motor vehicle) are enjoyed or received by employees as a result of their employment the benefits are liable for FBT. Employers pay tax on benefits provided to employees or shareholder-employees. For motor vehicles however we have new vehicle ownership structure mechanisms available to minimise this FBT exposure. Please contact us for further information on this matter.

Close companies can elect to calculate the deduction for the business use proportion of vehicle expenses as an alternative to FBT. The requirements to use this option are:

- Employer is a close company

- Only fringe benefits provided to all employees are 1 or 2 vehicles to shareholder employees

- Vehicle is acquired or first used for business use on or after 1 April 2017

- Company gives notice to IRD of election by the income tax return due date for the relevant income tax year

21. Land Sales – Zero-rating Transactions

The GST registered vendor is to charge GST at the rate of 0% on any supply that involves land or in which land is a component to a registered person who acquires the goods with the intention of using them for making taxable supplies.

22. Research and Development

Research and Development Loss Tax Credit

The research and development (R&D) loss tax credit is a refund of R&D business losses. The credit can only be for

- eligible R&D business expenditure

- up to 28% of your tax losses from R&D activity

- companies who are a tax resident of New Zealand

- dates on or after 1 April 2015

Generally you carry forward tax losses to the next income year, however the R&D loss credits are not carried forward but rather cashed out. These losses must then be repaid when the business begins to make a profit or owes repayment tax following a loss recovery event.

Research and Development Tax Incentive

(a) Research and Development Loss Tax Credit

The research and development (R&D) loss tax credit is a refund of R&D business losses. The credit can only be for eligible R&D business expenditure up to 28% of your tax losses from R&D activity companies who are a tax resident of New Zealand dates on or after 1 April 2015.

Generally, you carry forward tax losses to the next income year, however the R&D loss credits are not carried forward but rather cashed out. These losses must then be repaid when the business begins to make a profit or owes repayment tax following a loss recovery event.

(b) Research and Development Tax Incentive

The research and development (R&D) tax incentive operates as a tax credit, rewarding businesses and individuals who perform R&D activities. This is different to the R&D loss tax credit.

Key features of this incentive include:

- 15% tax credit available from the beginning of business (2020 tax year)

- minimum eligible R&D expenditure of $50,000 a year

- maximum eligible R&D expenditure of $120 million a year

- definition of R&D to span more sectors

- limited form of refunds in the first year

In order to take advantage of this, you must be eligible in all three of the following criteria:

- eligible R&D activities

- eligible R&D entities

23. Bright Line Test - Property

The legislative measures enacted in this first stage are as follows:

(a) The following pieces of information are to be supplied to Land Information New Zealand (LINZ) by any person transferring any property as part of the usual land transfer process:

- Their NZ IRD number; and

- Their tax identification number from their home country if they are currently [also] tax resident overseas.

(b) To ensure that NZ’s full anti-money laundering rules apply to non-residents, before buying a property in NZ, offshore persons must have a NZ bank account number before they can get a NZ IRD number.

An offshore person is defined as anyone other than a person who is not an offshore person. A person is not an offshore person if:

- They are a NZ citizen and have been in NZ within the last 3 years; or

- They hold a NZ residency class visa and have been in NZ within the past 12 months.

All other individuals will be offshore persons.

A non-individual will be an offshore person if it is:

Incorporated outside NZ; or

25% or more owned (legal or beneficial) or controlled by an offshore person.

(c) There is an exemption from supplying the information to LINZ if the property being transferred is the person’s main home. This exemption however is not available to an offshore person, where the property is to be or was owned by a trust, or if the person is selling their main home for the third time in a two-year period.

The second stage introduced a new easy to enforce, objective bright-line test to tax gains from the disposal of residential land acquired and disposed of within two years of acquisition, subject to some exceptions. The rules apply from 1 October 2015. The period that applies has been increased to within 5 years of acquisition; this is started from 1 April 2018.

The main home exemption prior to 27 March 2021 was given based on the ‘Predominant Use Test’ where a property is considered a person’s main home if it is predominantly used as the person’s main residence.

However, from 27 March 2021, the ‘Change-of-use Rule’ has been introduced. Under the new rule, if your main home was not used as your main home for any continuous period(s) of more than 12 months during the bright-line period, the main home exclusion will not apply to the period(s). This will mean that you will pay tax on the portion of profit that relates to the period(s).

The bright line period has now been extended to 10 years for residential properties acquired on or after 27 March 2021 unless the property purchased meets the definitions of ‘New Build’ which then the bright line period remains 5 years. The new build is a property that CCC was issued on or after 27 March 2020.

The start and end dates are specifically defined and may differ depending on the nature of the transaction. The following tables give a summary of the start and end dates for purposes of the bright-line test;

Type of acquisition Start date of bright-line test

Standard purchase of land Registration under LTA1952

Sales without registration of title Latest date property acquired (ordinary rules)

Sales “off the plan” Date of entry into a contract to purchase

Subdivided land The original date of registration for the undivided land

Converting a lease with a perpetual Date the lease with a perpetual

right of renewal into freehold title right of renewal is acquired

Type of disposal End Date of bright line test

Standard purchase of land Date of entry into agreement for sale

Gift Date of gift (generally registration of title)

Compulsory acquisition Date of compulsory acquisition

Mortgagee sale Date land disposed of by mortgagee

Other disposals where no Date of disposal according to ordinary rules

contract to sell

Only residential land is caught by the new bright-line test. Residential land is land that either has a dwelling on it, the seller of the land is a party to an arrangement that relates to erecting a dwelling on it, or is bare land that is zoned for residential purposes. However, if the land is used predominantly as business premises or is farmland then the land is not residential land.

The bright-line test also has a main home exemption whereby a sale of a main home within two years of purchase will not be subject to tax. However, to qualify the land must have actually been used predominantly, for most of the time the person owns the land, for a dwelling that was the main home of the person or a beneficiary of a trust that owns the property.

A person can only have one main home at a time (some overlap may be permitted in certain situations such as a pending sale of a prior main home when a person has already moved into a new main home) and habitual sellers cannot use the main home exemption. A person is a habitual seller if they have either used the main home exemption twice in the previous two years or have engaged in a regular pattern of buying and selling of residential land.

There is a limitation for trusts selling residential land that want to use the main home exemption. For tax purposes, a settlor of a trust is anyone who has transferred value to the trust for an inadequate consideration. A trust cannot use the main home exemption when a principal settlor of the trust has another main home. This rule is to ensure that people cannot use the main home exemption multiple times through the use of a trust. A principal settlor is the person who has made the greatest transfer of value to the trust. However, if the person providing the most value to the trust has made the provision with no strings attached and is not a beneficiary, trustee, appointor, a person with a contingent interest in the trust property or a decision maker under the trust, then their settlements are disregarded.

Other exemptions from the bright-line test are:

- Inherited properties - Transfers from the deceased to the estate and from the estate to beneficiaries are deemed to be at cost (no gains arise) and the on-disposal within two years of receipt by the beneficiaries of the inherited property is exempted.

- Relationship properties – transfers between the parties pursuant to a relationship property agreement are deemed to be at cost and therefore no gain arises. However the on-disposal of the transferred property within two years by the recipient party will be subject to the bright-line test.

- Resident’s restricted amalgamation – the existing rollover relief, where a transfer of property as a result of an amalgamation (held on revenue account by virtue of application of sections CB 9 to 11 and CB 14) is treated as transferred at cost, is extended to include property that is revenue account property of the amalgamating company due to the application of the bright-line test.

Other key aspects of the bright-line test are that:

- The cost of the property is tax deductible, including expenditure related to the acquisition and cost of capital improvements made after acquisition. Other holding costs may be tax deductible if sufficient nexus exists with income. Interest costs may be automatically deductible if the property is owned by a company.

- Losses from deductions claimable solely against bright-line income are ring-fenced so they can only be offset against gains on other land sales that are taxable under any of the land sale provisions.

- Specific anti-avoidance provisions have been included to defeat the use of land-rich companies and trusts to circumvent the intent and purpose of the bright-line tests, such as disposal of 50% or more of shares in the company that owns residential land, which will be subject to the anti-avoidance provisions.

Offshore property speculators now pay a withholding tax on profits from sales of residential land under the bright-line test which is the lower of:

- 33% of the vendor’s gain on the that property (39% from 1 April 2021) and

- 10% of the total purchase price of that property.

This withholding tax is known as the Residential Land Withholding Tax (“RLWT”).

24. Disallowed interest deduction for residential rental properties

The government has recently announced that deductions for any interest paid on residential rental properties will not be allowed from 1 April 2021 with a few exceptions including investment in new builds and property development exemption. 100% deduction will be allowed for any interest paid from 1 April 2021 to 30 September 2021, then it will be reduced to 75% from 1 October 2021 to 31 March 2022.

Interest deductibility then will be phased out eventually to 0% from 1 April 2026. The phasing out rule is applied to residential property acquired before 27 March 2021. Interest deductibility will be immediately ceased for any property purchased on or after 27 March 2021 from 1 October 2021.

If you have mortgages against your rental properties, please contact our accountants to discuss about the new interest deduction rule so we can plan ahead your tax for your rental investments.

25. Trust Act 2019 – new disclosure requirements

The Inland Revenue Department has announced that the new reporting and disclosure requirements will apply to NZ domestic trusts from the 2022 financial year. The new requirements include standards for meeting the minimum requirement when preparing financial statements and the finer details on information mostly around distributions, settlements and vesting etc. This information now needs to be disclosed when filing the annual income tax return for trusts going forward.

From the 2022 financial year going forward, NZ domestic trusts must prepare financial statements with prescribed information and submit it to the Inland Revenue along with trust income tax returns. If the trust does not derive annual income in excess of $30,000, or does not incur annual expenditure in excess of $30,000, and the total value of assets does not exceed $2 million, there will be less reporting requirements imposed, however a minimum requirement financial statements must be prepared and submitted unless trust is inactive.

All trusts should undergo a review about the changes before the 2022 tax returns are submitted to the Inland Revenue. Please, contact our accountants so we can guide you through the changes and provide you with solutions.

26. Have you received any Covid related support payments?

You will need to account for tax implications on the Covid supports received from 1 April 2021 to 31 March 2022.

- Wage Subsidies: if you received wage subsidy as an employer, wage subsidies received will offset the total wage expenses incurred during the year. If you received wage subsidy as a self-employed and is not receiving wages through PAYE returns, any wage subsidies will be added to your tax return separately as taxable income. No deduction is allowed for this government subsidy income.

- Resurgence Support Payment: for any resurgence support payment received, GST will be paid on the total payment received for GST-registered businesses and the rest will offset any business-related expenses incurred during the year. Any unused RSP will be carried forward as a business liability and is not added to the income of the business for the year.

- Covid Support Payment: same treatment will be applied to CSP.

In case you have received any grants, subsidy or support payments from any other organisations or government bodies, please let your accountant know so we can apply the correct treatment for them.

If you wish to discuss about any listed above or have queries regarding this checklist, please feel free to contact your accountant for assistance.