ATAINZ Update July 2021

Update from the Chair

I have enjoyed being able to meet with many of our members at the ATAINZ regional meetings in the last few months, and hopefully I will be able to visit a few more before the end of the year. A focus for ATAINZ at the moment is discussing the proposed changes to our membership categories. The introduction of RTBA (Registered Tax and Business Advisor) will ensure that our membership types fit with our current membership base.

It has also become apparent through discussions with Inland Revenue, that there is need for regulation in the accounting industry in particular who can become a Tax Agent. We support this view and want to make sure that all our members who are tax agents, are qualified/skilled in the services they provide to taxpayers.

ATAINZ continues to work with Inland Revenue regarding their communications to our clients and we continue to provide our feedback regarding IR initiatives. One area in particular which we have provided assistance is in the Public Advice and Guidance area of IR (in the Tax Counsel Office). We have also started to work with the Policy and Regulatory Strategy team at IR who are developing policy initiatives and requiring feedback from the SME sector on new legislation.

We are also continuing to work with our professional partners. TMNZ is our Principal Partner, and we currently have Strategi and MYOB as Major Partners. We thank our members for supporting the organisations that have chosen to support us.

I look forward to sharing some more news from the Board over the next few months, in the meantime take care and try to work smarter not harder!

|

|

PTBA and ATBA Update

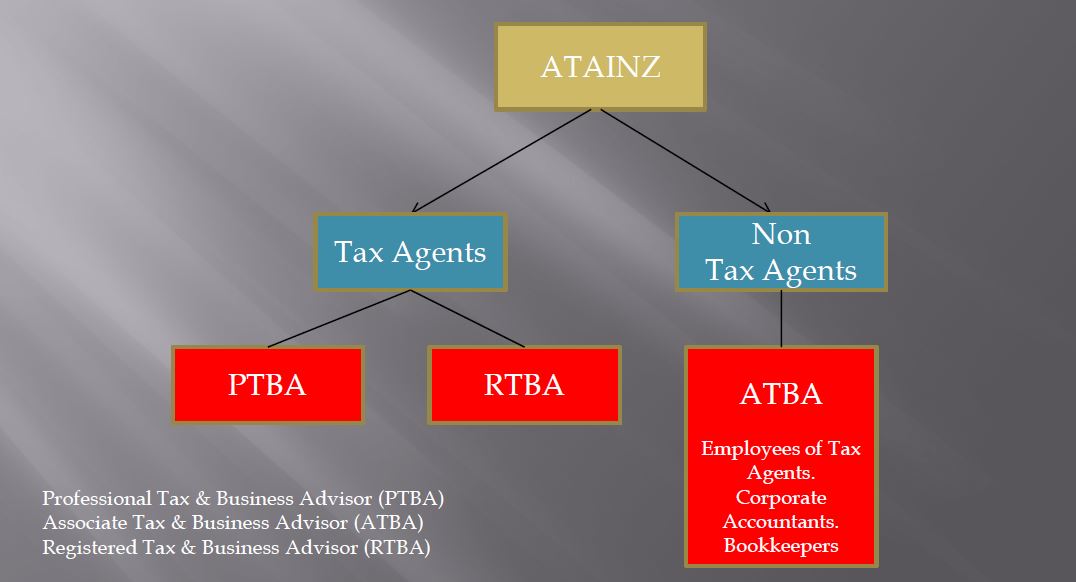

As a result of the development of the PTBA and ATBA membership categories and the recent growth of member numbers, it has become obvious that ATAINZ needs to evolve to meet member requirements. Not sure what the difference between PTBA and ATBA is? Check out our flowchart to demonstrate who fits in each category.

|

|

Interest limitation and additional bright-line tests

|

|

Our very own Terry Baucher on behalf ATAINZ has spent considerable time providing an amazing submission on interest limitation and the additional brightline tests this month to the Inland Revenue.

ATAINZ is at the forefront of supporting our members on these topical subjects that the government has indicated that it will pass into tax law from 1st October 2021. The submission from ATAINZ was in response to the consultation documents release by the Inland Revenue in June 2021.

In Summary these are the proposed changes.

Investment property changes

For properties acquired on or after 27 March 2021:

- Legislation has been passed that extends the bright-line test from 5 years to 10 years on residential property.

- The Government intends the bright-line test to remain at 5 years for new builds and is consulting on what a new build is.

- A new “change of use” rule provides that if the sale of a property is subject to the bright-line test and the property is not used as the main home for 12 months or more, income tax is required to be paid on a proportion of the profit made through the property increasing in value.

- If the property is sold within 10 years of acquiring it (or 5 years for a new build) and it was the main home for the entire time it was owned, tax will not need to be paid under the bright-line test on any gain in value.

- Any gain in property value that is considered taxable income (including under any of the bright-line tests) will also affect any other obligations or entitlements people may have based on taxable income, such as student loan repayments, child support payments, and Working for Families.

For property acquired before 27 March 2021:

- The previous bright-line test for 5 years will continue to apply for properties acquired before 27 March 2021.

- The Government has proposed that interest on loans for investment properties acquired before 27 March 2021 can still be claimed as an expense, but the amount will reduce each year until it is completely phased out by the 2025–26 tax year.

In the submission we relied upon our members feedback and Terry’s involvement with the External Reference Group discussions. Below are some of the points raised.

We have made the suggestion that the rules be deferred until the start of the 2022-23 income year to enable all taxpayers and advisors to fully understand the implications and ongoing obligations.

- Commented on the unintended consequences contrary to the Government’s desired intentions particularly in relation to the proposed “new build” exemptions.

- We have asked the interest limitation to be measured with rental income and limited to a 50% deduction.

- We have agreed with tracing of loans and for calculating the high-water mark level of pre-27 March loans.

- We consider the new build exemption should apply only to early owners and should apply for a minimum period of 25 years.

- We consider that the effect of the proposals is to require a property-by-property approach to determining interest deductions. Consequently, we consider the existing rental loss ring-fencing are no longer required and should be repealed.

The full submission will be available on our website soon.

|

|

Accounting for the Wage Subsidy

The COVID-19 wage subsidy and leave payments from MSD received by self-employed persons/other individuals are considered a compensation payment under section CG 5B and must be included as income in your IR3/IR3NR return.

You can find examples of various scenarios applying to self-employed persons and other individuals in Accounting for the wage subsidy - IR1251 below.

|

|

ATAINZ Workshop Friday 1st of October 2021

We are pleased to confirm the 2021 Workshop scheduled to be held on Friday 1st October 2021 at Waipuna Conference Suites Highbrook, Auckland has reached 175 registrations!!

For those who are yet to register we suggest that you do so ASAP so that you do not miss out.

To register simply go to the ATAINZ website and click on Conference/Workshop then click on Make Your Workshop Booking.

On the 26th August ATAINZ will celebrate its 45th Anniversary and to recognise this, any Member who registers for "In-Person" attendance for the Workshop will receive a quality ATAINZ branded Sistema drink bottle.

The Workshop has an awesome lineup of Presenters and is one not to be missed, with highly regarded Economist Tony Alexander providing an economic update and Conference regular Scott Mason who will be joined by our own Terry Baucher to provide an update on all the recent tax legislation changes.

For anyone who requires accommodation Quest Serviced Apartments are located adjacent to the Workshop venue.

|

|

July Inland Revenue Tax Agent Update

|

|

TMNZ - Tax Management New Zealand

With the 1st Instalment of provisional tax due this year by 30th August 2021 we will all be sending reminders to those clients that are liable to pay provisional tax this year. This is an opportunity for you engage with TMNZ to purchase and finance your client’s provisional tax due.

A great way to preserve your cashflow and defer your payment if necessary until next year. To find out more please visit the TMNZ website and contact your ATAINZ member directly to receive quote and some further understanding on how this may help you - www.tmnz.co.nz

|

|

Check out the latest Business Transformation Webinars available through Inland Revenue.

This includes:

Introduction to the changes coming in October 2021

Introducing the myIR version upgrade

Introduction to the new navigation in myIR

Introduction to what's changing in 2021

|

|

It's our 45th Birthday - so to celebrate we have decided to combine it with our 2022 Conference!

Help us celebrate our 45th anniversary in style at our 2022 annual conference. We are excited to let you know the conference/celebration will be held on the 12th – 13th March 2022, at the Rydges Lakeland Resort Queenstown!

Save the date! More details for registering online to coming soon.