|

|

|

|

April 2022

Keep up-to-date with us and what's happening in the business world

- Happy Easter & AAF Out-Of-Office Dates

- Goal setting for the New Financial Year: Tips on how to plan for success

- Xero Tip of the Month - Create a Xero desktop shortcut

- IRD Upcoming Tax Payment Dates

- Question of the Month: Does converting a residential rental property to a family home trigger a bright-line disposal??

|

|

HAPPY EASTER & AAF OUT OF OFFICE DATES

The All Accounted For Team would like to wish you and your family a safe and happy Easter break. Whether heading away or staying local, we hope you enjoy some well-deserved relaxation with friends and family.

After a challenging start to the calendar year, our valued and hardworking team will be taking an extended break over the upcoming Easter/ANZAC period, from Friday 15 April 2022 to Monday 25 April 2022 to relax and recharge. We would like to thank our valued clients for their ongoing support and patience, particularly around recent staffing levels due to COVID-19 impacts.

Regular office hours will resume on Tuesday, 26 April 2022. Ben will be around if you need any urgent business assistance during the break; you can contact Ben on 021-915-233.

|

|

Happy New Financial Year (2023 tax year)

The start of a new financial year is the perfect time to dust off last year's business plan and set some new goals for the year ahead. As you look back over the previous year, how happy were you with your business performance? Are you patting yourself on the back, having nailed every goal?

At All Accounted For, we are big fans of goals & setting clear direction, focus, and intentions for the year ahead to ensure you maximize all potential opportunities, stamping out any unforeseen setbacks while reducing costs where possible. As such, we've put together a few tips below to help you set your business up for success in the new financial year ahead.

REVIEW YOUR FINANCES:

Kick off the new financial year by reviewing your financial statements from last year, looking for things like:

- Where you spent the most money

- How much you paid in fees or interest

- Any recurring subscriptions

BE REALISTIC:

When it comes to goal-setting, thinking big is great, but in order to make those big ideas like "growing profits" or "increasing market share" happen, setting more specific, smaller goals and strategies tried to a budget and timeline will give your business a clear sense of direction and keep your team focused, resulting in steady growth and success if managed correctly.

For instance, while your overarching objective may be to grow your profits by 50% by the end of the next financial year, your smaller goals might include:

- Launching a social media campaign for the first week of June to attract 2,500 new prospects by month's end; or

- Increasing total sales by X% with the opening of an online store by 1 July.

The key is to define goals that are measurable and achievable.

STEAMLINE YOUR SYSTEMS & REVIEW TECHNOLOGICAL PROCESSES:

Are you doing things the way they've always been done? Is there any technology that you could utilise to simplify or automate your business processes?

Implementing the right technology could save your business valuable time and money by improving productivity, management and minimizing risk. From tracking profitability to streamlining and automating your business processes, taking advantage of free trials and live demonstrations to test systems out is the way to go.

Interested to hear more? Need help with discovering and meeting your business financial goals? Give us a call today, and together, let's make 2023 the best financial year for you and your business.

|

|

XERO TIP OF THE MONTH - CREATE A XERO DESKTOP SHORTCUT

Want to shave more seconds off your bookkeeping? Speed up your login by creating a Xero shortcut on your desktop to allow quick and easy access to your Xero file. Its a simple trick but convenient one nonetheless!

Create a shortcut on your desktop and access the login screen directly without typing in the Xero’s address.

This is how you can do it. On windows desktop:

- Right click and and go to “New”

- click “shortcut”

- Enter the URL above in, “Type the location of the item” field. Again, make sure to replace the capital letters in the URL with your username.

- Click “Next”

- Type the name for this shortcut and click “Finish”

That’s it. Just open up this shortcut every time you need to access Xero accounting software. It will take you to your login screen where you username is already entered. Enter your password and start working.

|

|

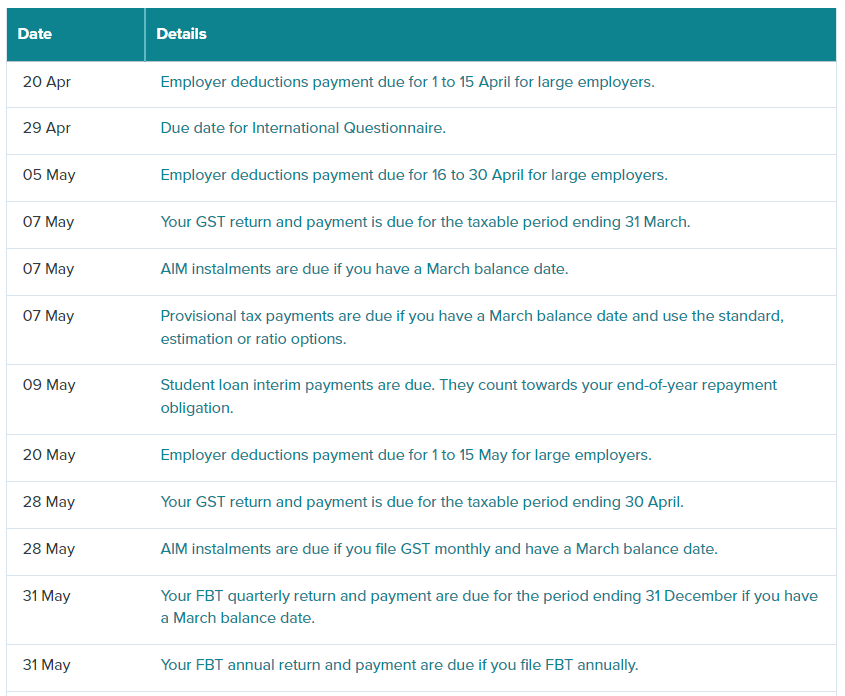

IRD UPCOMING TAX PAYMENT DATES

|

|

QUESTION OF THE MONTH:

QUESTION:

Ms A purchased a residential rental property in April 2019.

After three years renting the property, she has decided to move into the property and make it her family home. She is concerned whether the bright-line test applies to her once she moves.

Her concern arises from the Inland Revenue's IR264 Rental Guide at page 39 which states: "If you stop renting your own home and move back into it (or move into a property you have been renting), for the purpose of depreciation it is treated as if you’ve sold the property. Although that particular paragraph is talking about depreciation recovery, she is concerned the same principle applies to the bright-line test.

Hence, if Ms A moves into the property that she has rented for only three years, will she be subject to the bright-line test and have to pay tax on the profit between the property’s current market value and its original cost?

ANSWER:

The bright-line test in the Income Tax Act 2007 applies only to disposals of residential land. The 5-year bright-line test that applies in this case is found at s CZ 39 (as the property was purchased in April 2019).

In the "Moving back into your own home" section of the IR264 guide, it expressly states that the property is treated as being sold for the purposes of depreciation. This is because deemed a change in use (IE: from rental to private use) is a disposal for the purposes of the depreciation rules. This does not create a disposal for any purpose other than calculating depreciation recovery income/loss on disposable.

Bright-line rules apply to residential property only when the property is sold, transferred, or otherwise disposed of within the relevant bright-line period. For there to be a disposal for the purposes of the bright-line test, there will generally need to be a change in ownership of the property.

Therefore, when a property owner moves into a property previously rented out, there may be depreciation recovery income to account for, but no bright-line tax will be imposed on any capital gain from the time of purchase to the change in use.

However, when the property is eventually sold, this may trigger a bright-line disposal, depending on how long Ms A lives in the property as her main home. Because the property was purchased in 2019 (IE: before the main home-exclusion provision was changed in 2021) the relevant test is that found in s CZ 40; ie, the main home exclusion will apply if the property has been used as her main home for most of the bright-line period.

|

|