|

|

|

|

COVID-19 Special - 22 August 2021

Keep up-to-date with us and what's happening in the business world

- COVID-19 Wage Subsidy - How to Apply

- COVID-19 Resurgence Support Payment - How to Apply

- Summary of Other Financial Support Available for Businesses

- Xero Assistance Programme

Given the financial support options available due to the COVID-19 Alert Level 4 lockdown, we have pulled together information around how to apply.

The wage subsidy opened on Friday, 20 August 2021 for applications, with the Resurgence Support Payments applications expected to available from 9am, Tuesday 24 August 2021.

If you have any questions or would like some assistance applying for financial support, please contact Ben, Sarah or any of the AAF team.

|

|

COVID-19 WAGE SUBSIDY - HOW TO APPLY

Applications for the wage subsidy payments are now open. Around 50,000 businesses have already applied. The wage subsidy scheme continues to be managed and operated by the Ministry of Social Development (MSD) on behalf of the Government.

The application forms are straightforward to complete, with just basic business information and employee details (IRD numbers, date's of birth and average hours worked) required. There is one issue with the application form though, in that you cannot appear to print a copy (which must be done before your press submit), hence we would strongly recommend taking a screenshot of the application form as a record of the information submitted. "ALT, Print Screen" or using the snipping tool, are both good options to screenshot the application form.

Applications at this stage applications are open for two weeks, which means the cut-off date will likely be 9am, Friday 3 September 2021; the actual time and date has not been specified by MSD, just that applications are open for two weeks.

To qualify, your business must have or will probably suffer a 40% decline in revenue across a 14 day period, which must include days within the lockdown period. If you require any assistance with this calculation, please contact us. MSD, in the event of an audit, have indicated that they will be expecting more comprehensive financial information from wage subsidy applicants.

The amounts payable are $600 per week for full-time employees (20+ hours) and $359 per week for part-time employees (less than 20 hours). A common question is how to calculate the appropriate hours for part-time or casual staff. MSD guidance is to use the average over the past 12 months or if the employee has been employed for less than 12 months, average the hours during the period they have been employed. However, if an employees hours have changed significantly over the past 12 months, then average over a more reflective period, say the last 4 weeks.

There are two application forms, one for employers and one for self-employed/contractors. Note if you are a shareholder of the business and receive shareholder salary, include yourself within the employer's application form.

The MSD has advised that employers must have permission from employees in writing (emails from employees would be sufficient) when applying for the wage subsidy, and have recommended the distribution of their employee privacy guide, which can be found here - MSD Employee Privacy Information Guide.

If you have any questions or need any assistance, the team here at All Accounted For are happy to assist. The following buttons will take you to respective application pages on the MSD Work and Income website.

|

|

COVID-19 RESURGENCE SUPPORT PAYMENT - HOW TO APPLY

Businesses and self-employed can apply for the Resurgence Support payments, and in addition to the wage subsidy, if the business has or will probably suffer a 30% decline in revenue across a 7 day period within the Lockdown period.

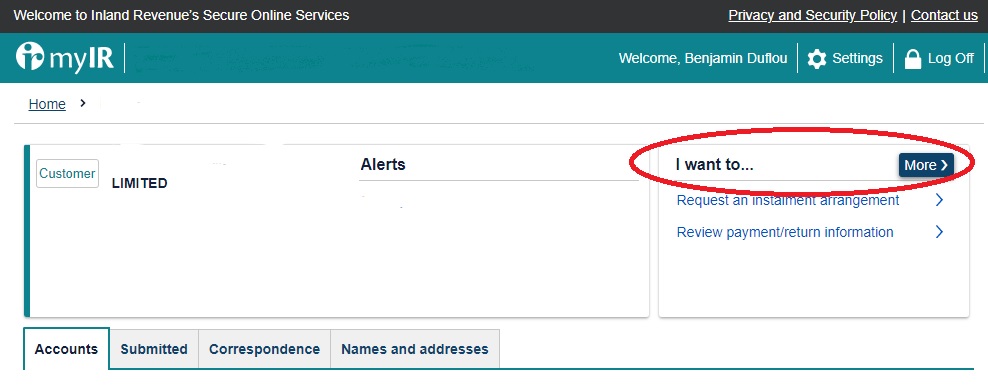

The Inland Revenue has advised that applications can be made from 9am, Tuesday 24 August 2021. Businesses will need to apply for the Resurgence Support Payments (RSP) via their business MyIR login. So if you do not have a business MyIR login, we would recommend registering over the next couple of days here - MyIR Registration.

Once you've logged into MyIR, select "Apply for Resurgence Support'' under the "I want to... More >'" and follow the instructions on the screen to complete your application.

We can apply for the payments on your behalf should you require assistance. We just need permission in writing; an email would be requesting AAF apply would be sufficient.

At this stage, the payment would be a one-off for the current alert level settings. This is unlike where the wage subsidy, which would probably be extended if Alert Level 3 or 4 continued beyond the two weeks covered.

The Resurgence Support amounts available are $1,500, plus $400 per full-time equivalents (FTE), up to a maximum of $21,500 for large groups with common shareholding. Employees that work up to 20 hours per week are consider considered part-time (0.6 FTE), while employees that work more than 20 hours are considered full-time (1.0 FTE).

So for example, you have 12 employees, 8 full time (8.0 FTE) and 4 part-time (2.4 FTE), the application is therefore for 11 employees as the calculation is rounded up to the nearest whole number (10.4 is therefore 11).

Further information on the Resurgence Support Payment can be found on the Inland Revenue website, by clicking on the button below. If you have any questions or need any assistance, the team here at All Accounted For are happy to assist.

|

|

SUMMARY OF OTHER FINANCIAL SUPPORT AVAILABLE FOR BUSINESSES

As per last year, we have includes a summary of the other financial support measures available for businesses:

- Leave Support Scheme (Available to cover employees that need to self-isolate and cannot work from home);

- Short-Term Absence Payments (Available to cover employees, including self-employed, who cannot work from home while awaiting a COVID-19 test result);

- Small Business Cashflow (Loan) Scheme (Up to $100,000 interest-free up to 24 months, loans for up to 5 years, if repaid can apply for one additional time, applications open to 31 December 2023) - Details Here;

- Use of money interest and penalty remission around late tax payments, if business impacted by COVID-19;

-

Apprenticeship Boost Scheme (Up to $1,000 per month for Apprentices enrolled into any approved training course, available until 4 August 2022); and

-

Business Debt Hibernation (Assistance for businesses to manage their debts, including creditors).

|

|

XERO ASSISTANCE PROGRAMME - SUPPORT MENTAL HEALTH & WELLBEING

This programme is still available free of charge to all starter, standard and premium Xero subscribers, until 31 March 2022 at this stage.

This service provides free and confidential wellbeing support to New Zealand small business owners, their employees and families. Users will have access to face-to-face, telephone, live chat and online counselling, as well as through an app.

This is one of the ways business owners can make a sizeable impact on mental wellness in the country.

For information on how to access Xero Assistance Programme, email xap@xero.com.