|

|

Keep up-to-date with us and what's happening in the business world

- Ring-fencing Residential Rental Property Losses

- EQC Act Changes

- Insurance for Home-based businesses

- Hubdoc

- Client Profile: KAP Consultancy NZ - professional learning network

- Upcoming Tax Dates

|

|

Ring-fencing Residential Rental Property Losses

The Taxation (Annual Rates for 2019–20, GST Offshore Supplier Registration, and Remedial Matters) Bill has become law. Of impact to residential property investors, is that losses from rental properties can no longer be used to offset tax on other sources of income, such as salary and wages. Going forward, losses can only be used against other rental losses in the investor’s portfolio, or against taxable gains from the sale of property. Read more info on our website blog HERE.

This Bill also includes the following law changes:

- enables the collection of GST on low-value imported goods;

- ring fence losses derived from rental properties;

- require most buyers and sellers of property to provide LINZ with their IRD number;

- enables making of regulations to temporarily address inconsistencies with tax laws;

- allow entities to keep their tax records in te reo Māori; and

- exempt some victims of sexual violence from paying child support.

If you have any questions relating to these law changes and how they may impact you, please contact us.

|

|

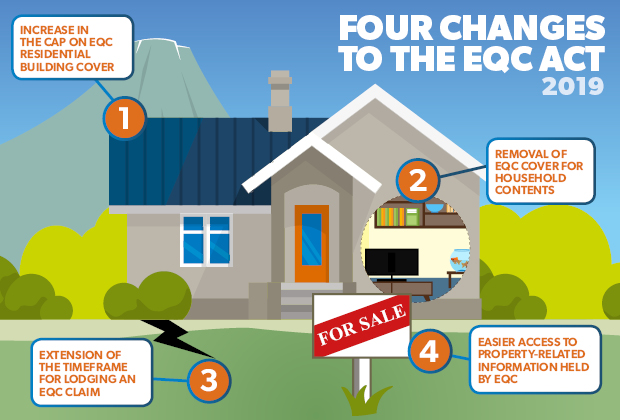

EQC Act Changes

EQC has learnt some lessons from the Canterbury earthquakes and have made changes with the aim of improving the EQC claim management process and customer experience.

There are four key changes to the law:

- further scope for EQC to share property-related information as necessary to settle claims;

- extension of the timeframe for lodging a claim from three months to two years;

- removal of the $20,000 EQCover for contents;

- an increase in the cap on EQC residential building cover to $150,000 (+ GST).

Changes to contents cover and the increase in the residential building cap will be phased-in over 12 months from 1 July 2019, affecting policy holders on the anniversary date of their existing policy, or if you take out a new policy. Under the changes, EQC will continue to insure residential buildings and land, although EQC will no longer provide cover for contents.

If you are a landlord, you should also ensure your tenants are aware of the new regulations and have adequate cover. We recommend you talk to your insurance provider, or we can put you in touch with Darren Butter of Kauri Financial Planning to assess your risks and needs. You can contact him directly at darren@kaurifinancial.nz or on 022-524-9531.

Make sure you are not at risk of your contents being uninsured in the case of a natural disaster.

Insurance for Home-based Businesses

Home insurance is based on the assumption that the property is solely residential. If you run your business from home, you will need to advise your insurance provider, as there are several factors that they need to take into account, depending on the level of risk.

It is also important to note that if more than 50% of your floor area is used for business purposes, then this area won't be covered by EQCover and most home insurance policies won't cover natural disaster damage if EQCover isn't available.

Your insurance provider can help you weigh up your options and ensure adequate cover. If you would like to discuss further, contact Darren Butter of Kauri Financial Planning. You can contact him directly at darren@kaurifinancial.nz or on 022-524-9531.

Be honest and upfront with your insurance advisor to reduce the risk of a rejected claim.

|

|

With Hubdoc, there are three ways to get your receipts and bills into the software, simply:

Hubdoc saves the statements, extracts the relevant data and then publishes directly to Xero if you wish. Are you like the rest of us and wanting to go paperless? Hubdoc can help you with this mission and streamline this process for you. Your important financial records are organised automatically for you, backed up forever and available on any device. Hubdoc is your secure digital filing cabinet in the cloud.

All Accounted For are partners with Hubdoc and can set up an account for you at a reduced cost, as well as having oversight of your account and bills. Let us help you help yourself!

Client Profile

KAP Consultancy NZ

Kirstin Prince

Kirstin started KAP Consultancy NZ in 2015, which has created a professional learning network that is inspired and designed by teachers, for teachers. We are a current supplier for Ministry of Education, providing professional learning and development support to early childhood centres to strengthen the early childhood sector.

Our Senior Teacher brand provides workshops and an eLearning platform for continued professional development aimed at the education sector.

All Accounted For have been working alongside Kirstin since the beginning, providing accounting and growth advice for KAP Consultancy NZ and also comprehensive financial solutions for some of her clients.

To see if KAP Consultancy NZ can help you, visit their website at kapconsultancy.co.nz.

|

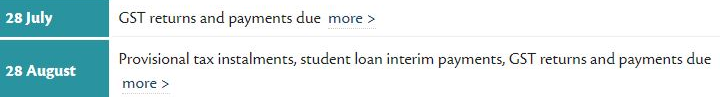

|