|

|

|

|

November 2021

Keep up-to-date with us and what's happening in the business world

- COVID-19 Resurgence Support Payment #4

- COVID-19 Wage Subsidy Payment #6

- ACC Payment Options: ways to pay your levy invoice

- Inland Revenue Scam Emails

- IRD Upcoming Tax Payment Dates

- Xero Tip of the Month - The plus icon

- Welcome to the team: Abhay, Kerrin, Ian and Maria

- Question of the Month: Can depreciation be claimed on a flat used for a B&B activity?

COVID-19 RESURGENCE SUPPORT PAYMENT #4

Applications for the fourth round, Resurgence Support Payment 2021 #4, opened Friday 29 October 2021 and will remain open until Auckland moves to the new COVID-19 Protection Framework. From 12 November 2021, the Resurgence Support Payments move to a two-weekly payment, but at double the amount; so essentially a weekly payment.

Key Criteria:

- Businesses need to show a 30% or more drop in revenue in a 7-day period from 22 October 2021 until immediately before all of NZ returns to Alert Level 1, compared to a typical 7-day period in the 6 weeks before 17 Aug.

-

The 4th payment will stay as $1,500 plus $400 per full-time equivalent (FTE) employee up to a maximum of 50 FTEs, or four times the actual revenue decline experienced by the applicant, whichever is less.

- Following last week's government announcement, subsequent RSP payments will be for $3,000 plus $800 per FTE, still up to a maximum of 50 FTE. They will be available fortnightly, on 12 November, 26 November and 10 December as long as Auckland has not moved to the COVID Protection Framework.

If you have any questions or need any assistance, please give us a call.

For further information or to apply, click the below button which will take you through to the Inland Revenue website.

COVID-19 WAGE SUBSIDY #6

Applications for the sixth round, Wage Subsidy 2021 #6, also opened Friday 29 October 2021 and will remain open until 11.59 pm, Thursday 11 November 2021.

Key Criteria:

- Businesses need to show at least a 40% drop in revenue between 26 October 2021 and 8 November 2021, compared to a typical 14 consecutive period of revenue in the six weeks immediately before the move to Alert Level 4 on 17 August 2021

- Payments remains the same at $600 a week for each full-time employee retained (20 hours a week or more) or $359 a week for each part-time employee retained (less than 20 hours a week).

- You can apply two weeks after your last Wage Subsidy application, even if you are waiting on the last application to be granted. Businesses that didn't apply for earlier wage subsidies are welcome to apply for Wage Subsidy #6.

If you have any questions or need any assistance, please give us a call.

For further information or to apply, click the below button which will take you through to the Work and Income website.

|

|

ACC LEVY PAYMENT OPTIONS:

When it comes to payment of your ACC levy there are a number of ways you can pay online.

The different ways you can pay and the benefits of each are:

1. Paying with your credit card:

This will allow you to collect Airpoints but if you are with ACC bank or Westpac this will incur a 1.9% convenience fee on all credit card payments.

2. Pay via internet banking: No fees or administrative / processing costs.

3. Direct Debit : set up a one-off payment or an installment plan:

Direct debits are a great option as you can simply " set and forget" reducing the chance of missing a payment. The great thing about installment plans also is that they will automatically roll over next year.

There are no interest or processing fees for installment plans that are less than 10 month in length (10 months plan will incur a 2.73% admin fee).

Although what will suit you and your business will depend on your specific circumstances, the direct debit option offers the most benefit compared to manually paying your invoice each month.

For more information and to set up a DD, please click the below button which will take you to the ACC Payment Levies website section.

|

|

INLAND REVENUE SCAM EMAILS

Have you been asked to provide your credit card or bank account details to someone over the phone claiming to be Inland Revenue? It may be a scam. IRD will always ask you to supply this information securely through your myIR account.

Here are some signs to lookout for:

- It includes a refund amount which is something we never do in an email

- There’s a teal hyperlinked “Login” button to log in to myIR. We will always ask you to log in to your myIR account directly via ird.govt.nz.

- It’s not from an Inland Revenue email address

If you’ve received an email like this do not respond or click the links. Instead, please forward to the IRD phishing team at phishing@ird.govt.nz

|

|

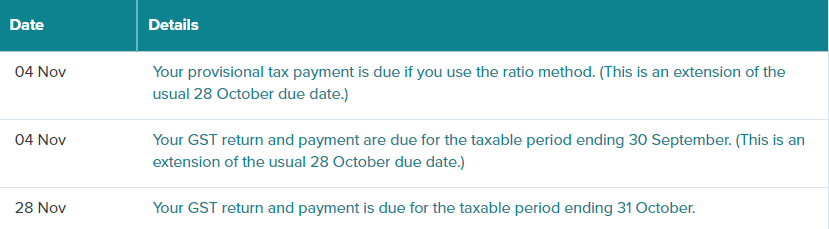

IRD UPCOMING TAX PAYMENT DATES

|

|

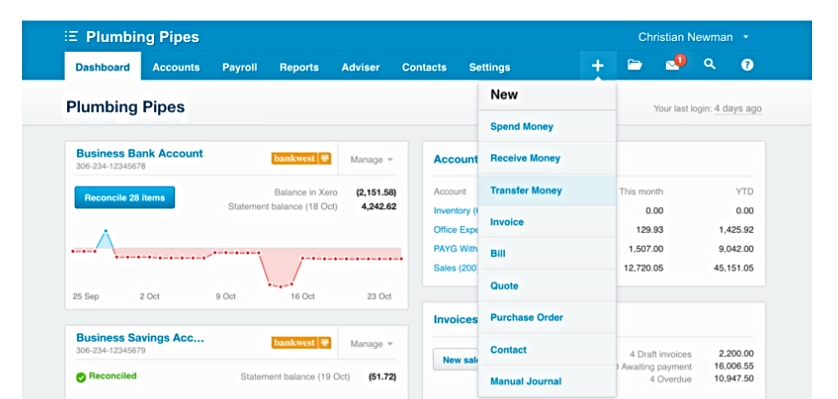

XERO TIP OF THE MONTH - THE PLUS ICON

Want to save time streamlining your actions on Xero?

When you log in to Xero, you will see a little plus icon (+) at the top right of the screen. Although it may seem like such a small detail, this one icon can be extremely helpful as the icon will let you access common actions in Xero from anywhere in the application.

Clicking this icon lets you quickly access several different functions, such as creating a new invoice, contact, bill or purchase order. This shortcut will save you time and help you develop a flow within your accounting process.

|

|

WELCOME TO THE TEAM: ABHAY, KERRIN, IAN AND MARIA

Abhay Joshi

Originally from Mumbai, India, Abhay graduated from the Wellington University of Victoria with a master in professional accounting.

As our new Business Services Accountant, Abhay will be working with you to prepare and provide crucial financial information while providing insightful strategic advice to support your business.

Abhay is passionate to genuinely help people and help ensure we maintain high levels of client service.

In Abhay's spare time, he enjoys travelling (domestically at present) and playing cricket for the Wellington Petone Club

Kerrin Hotop

Meet Kerrin, a local Wellingtonian with an extensive background in sales in the information technology and services industry with over 17 years of experience in management, payroll and HR.

Kerrin is our new Practice Manager and will be responsible for overseeing all of our administrative, marketing and IT business operations, making sure things run smoothly and seamlessly.

Outside of work, Kerrin enjoys spending time with her husband and four children. During the winter weekends, you'll find her on the netball courts umpiring for primary children.

Ian Tanasukitwanit

Ian grew up in Phuket, Thailand but has lived in New Zealand for the past 20 years. He studied at Otago University, graduating with an Accounting Technician Certificate in bookkeeping.

Ian has joined the team as our new bookkeeper and will be responsible for recording financial transactions and preparing source documents for all transactions and operations.

Ian has a thirst for learning and is looking forward to progressing his career as a bookkeeper while offering support to our team.

Ian's interests include cooking, baking and constructing magnificent structures and buildings with Lego.

Maria Joseph

Born and raised in Kerala, south of India, Maria relocated to New Zealand after completing her business studies at Bangalore University.

As our new bookkeeper, Maria will be responsible for recording financial transactions and preparing source documents for all transactions and operations.

With a love of numbers and the need for organization, Maria is looking forward to helping us record and maintain our financial records.

Maria's interests include gardening, cooking and socializing with her friends.

|

|

QUESTION OF THE MONTH: CAN DEPRECIATION BE CLAIMED ON A FLAT USED FOR A B&B ACTIVITY?

QUESTION:

A husband and wife have added a stand-alone flat to their house to enable them to offer a B&B service. A typical stay will be for a minimum of two nights with a maximum of five nights.

Are they able to claim depreciation on the cost of the flat used exclusively for the B&B activity?

ANSWER:

The depreciation rate for residential buildings is 0%.

A residential building is defined as a dwelling and includes a building intended to ordinarily provide accommodation for periods of less than 28 days at a time, if the building, together with other buildings on the same land, has less than 4 units for separate accommodation.

The flat added to the husband and wife’s home will be a residential building. It is intended to provide accommodation for periods of less than 28 days at a time and there is not more than 4 accommodation units on the site. Accordingly, the applicable depreciation rate for the flat is 0%.

|

|

|

|

P: (04) 970 1182 I E: advice@aafl.nz I W: aafl.nz