|

|

February 2022

Keep up-to-date with us and what's happening in the education sector

- COVID-19 relief funding for schools

- COVID-19 vaccine mandate relief support scheme

- Digital devices for learning: Options available

- School Spotlight: Wellington High School

-

Xero Tip of the Month : Create repeating invoices and bills

- Keeping your School Community in the Loop

|

|

COVID-19 relief funding for schools

During Term 1 2022, schools and kura can apply for additional relief funding where absences relate to a staff member that:

- has tested positive for COVID-19

- is caring for a dependent that is suffering from COVID-19

- is confirmed as a close contact and are directed to self-isolate by health authorities and

- are unable to work from home.

For teachers, the Additional Relief Teaching Funding (ARTF) policy has been reduced from eight days to four days, so you are now able to apply for ARTF where relief has been employed to cover COVID-19 teacher absences greater than four days.

For non-teaching staff, funding is available from the first day of absences where relief has been employed to cover COVID-19 non-teacher absences.

For further information around how to claim, click the button below.

|

|

Vaccine mandate relief support scheme

Schools who had to work though employment processes with staff who have not met the vaccine mandate requirements may be eligible for additional funding to fund part of the costs incurred.

The costs must relate to relief teachers that have been hired during paid notice periods directly related to staff members not meeting the vaccination mandate.

The funding is retrospective and is only available for relief staff employed during Term 4 2021 (18 October to 20 December 2021).

Eligibility criteria:

- The school must have entered an employment process which has resulted in termination of employment due to non-compliance with the COVID-19 vaccine mandate.

- The school must have incurred actual additional relief teacher costs i.e. a reliever was hired during the terminated employee's paid notice period.

- This fund will only provide support for the notice period, that is up to 4 weeks for non-teaching staff or up to 8 weeks for teaching staff.

- The affected staff must fit into one of the following 6 categories: principals, teachers, teacher aides, relief teachers and casual staff, caretakers and cleaners or administration staff; and

- The cost is not related to contractors and other tradespeople, service managers, caregivers, and other staff. It is considered these positions will be replaced on a contractual basis and therefore do not require inclusion for backfill of costs to employ relief staff; or may be volunteer staff members thereby negating the school incurring any costs; and

- The cost must have incurred between the dates of 18 October 2021 and 20 December 2021.

- If the paid notice period took place while the school was closed, no funded relief cover would be available.

Applying for the scheme

To apply for this funding, please click the below button to download an application form. Applications must be received by Thursday 14 April.

Please note, as applications are assessed on a case-by-case basis eligibility cannot be confirmed prior to an application being submitted.

If you have any questions or concerns relating to this, please contact our team for further assistance.

|

|

Providing digital devices for learning in your school or kura can give opportunities for students to learn, create, share and collaborate beyond the classroom. However, it is important to know what options are available to Schools/Kura when it comes to providing devices for tamariki.

Schools and Kura may:

- purchase or lease devices for use by students. If a device is required as part of the curriculum, parents and whanau cannot be charged for the use of the device. There are borrowing limits to apply to leasing to be aware of (repayments capped at 10% of the Schools operational grant).

- ask students to bring their own device (BYOD). A BYOD scheme may lower the ongoing capital commitments of the school or kura, however, this cannot be made compulsory; schools and Kura must still provide devices for students that are unable or unwilling to bring their own device.

- use its purchasing power to provide the school community an opportunity to purchase a device. Where the school or Kura has purchased devices, this sale should be treated as an item of stationery and full payment is made at the time of sale. Alternatively, where payment cannot be made in full, the sale should be completed directly between the parents / whanau and the retailer making the offer.

Schools and Kura may not:

- lease devices to students. A lease is a type of loan (debt financing) and is not allowed under current legislation.

- Offer ‘payment over time’ options to parents/whanau. This also creates a type of loan (debt financing) and is not allowed under current legislation.

- subsidize the cost of devices that students will keep.

For further information on providing digital devices to students click the button below.

|

|

SCHOOL SPOTLIGHT: WELLINGTON HIGH SCHOOL

A picnic courtesy of AFSL! Check out the lovely Sue Kemp of Wellington High School enjoying her new Accounting For Schools cooler bag!

We are proud to work with Wellington High School, a lively co-educational school in the heart of Wellington city with a diverse student population of approx. 1300+ students.

We love that Wellington High celebrates diversity, inviting their students to be the best person they can be by providing inclusive education through effective teaching, and the use of technologies, to develop lifelong, independent learning.

|

|

Accounting For Schools is proud to highlight the achievements of the many schools we work with, whether it is a special teacher that deserves a shout out or maybe your school has recently undertaken a new project achieving something extraordinary? Either way, we want to know about it!

Click the button below to tell us your story and you may be featured in our March 2022 Chalkboard!

|

|

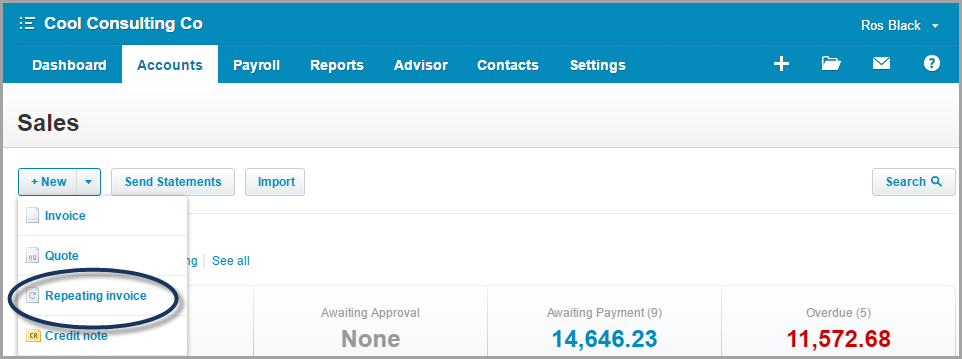

XERO TIP OF THE MONTH: CREATE REPEATING INVOICES AND BILLS

Do you have invoices you create and send regularly? Want to save yourself the time and trouble of having to repeat the same process again and again?

Utilize Xero's repeating invoice function by developing a template and Xero will automatically create an invoice or bill for you based on the frequency you specify. Xero will put it in the Draft tab if you need to vary the amount (or another field), and if everything is the same each time, it will go in the Awaiting Payment tab.

Again, this feature can be set up for both invoices and bills and is done by accessing the Repeating tab in each respective category. From there, click “New Repeating Invoice/Bill” and you’ll be able to create a new template or use an existing one, and set up the specifications you require.

|

|

KEEPING YOUR SCHOOL COMMUNITY IN THE LOOP

Need an easier, more efficient way of communicating within your school community? Download School Loop!

School Loop is an app developed to meet increased parent-teacher demand for simple communication between school staff and families. This app is completely free to use for schools and parents and is trusted by thousands of schools across New Zealand.

Here are just a few of the features school app includes:

- An easy, user friendly interface

- The latest school communication technology

- Parent-teacher interviews

- Calendars

- Multi-language translation

- e-permission slips

- promote events and activities

- Absentee reporting and much more!

To find out more, including how to download the app click the button on the right which will direct you to the official School Loop website.

|

|