|

|

|

|

December 2021

Keep up-to-date with us and what's happening in the business world

- Merry Christmas & AAF Out-Of-Office Dates

- COVID-19 Transition Payment (Resurgence Support Payment #7)

- Financial matters for the holidays

- IRD Upcoming Tax Payment Dates

- Xero Tip of the Month - Business Snap Shot Feature & Analytics Plus

- Welcome to the team: Kelly and Nerissa

- Question of the Month: Are Partners counted as "one group of persons" for grouping tax losses?

- New premises in 2022!

|

|

We know it has been quite a tough 2021 for everyone, and we know at times we have not always been spot on; the constant changes around the COVID financial support, investment property tax changes, and increased compliance obligations have consumed a signficiant amount of time over the last couple of year. Getting back to our where we've been in the past is the big focus for 2022.

We would really like to thank all our valued clients (friends) for their patience, understanding and support during 2021, as we have tried to assist everyone navigating these uncertain times. We are looking forward to less complex times in 2022.

The team at All Accounted For will be having a much-needed break over the Christmas and New Year period. If you need any urgent business assistance during the break, please text Ben (021-915-233) and he'll get in touch.

The team returns and the office re-open Wednesday 12 January 2022.

On behalf of the entire team, we would like to wish you all a safe and happy Christmas. We hope you find some time to relax with family and friends over the summer break and get out and about to enjoy this great country of ours.

|

|

COVID-19 TRANSITION PAYMENT (RESURGENCE SUPPORT PAYMENT #7)

The one-off Transition Payment:

Applications opened Friday 10 December 2021, for the one-off transitional payment (Resurgence Support Payment 2021 #7) and are available to all eligible businesses and organisations particularly in recognition of the length of time and restrictions Auckland, Waikato and Northland have had under the higher Alert Levels.

Businesses and organisations may be able to get the payment if a 30% drop in revenue is experienced due to the increased alert levels in a consecutive 7-day period between 3 October 2021 and 9 November 2021 (that's any 7 day period). The drop in revenue must be compared to a typical 7 days in the 6 weeks prior to 17 August 2021.

All other eligibility criteria remains the same as previous resurgence support payments.

Applications will remain open until midnight on 13 January 2022.

Resurgence Support Payment (RSP) available to more businesses:

Businesses that changed ownership on or after 18 July may be able to get the RSPs made available from 29 October.

To get an RSP in this situation, the business:

- needs to meet the RSP criteria

- must have been operating for at least 1 month before 17 August

- activity must remain largely the same as before the change in ownership.

There are no additional rounds of the Wage Subsidy or Resurgence Support Payment planned at this stage, so if you need some additional assistance with getting that cash flow going again in the new year, please touch base with the team here at All Accounted For.

For further information or to apply, click the button below which will take you through to the Inland Revenue Website.

|

|

FINANCIAL MATTERS FOR THE HOLIDAYS

We would again like to thank you for your continued support throughout the year; we know it has been quite a challenging 2021 for everyone, and we are looking forward to some brighter times ahead in 2022. Whether you are closed for the holidays or operating the throughout, we have put together a short list to help you best work through the holiday season.

- Create a staff roster allowing you to manage staff leave over the holiday season, making a note of when each staff member will be working and when they are taking a break so you've got enough hands on deck over the holiday period.

- Pay any outstanding invoices or upcoming invoices.

- Plan for your upcoming tax payment obligations.

- Schedule your staff pay runs if you aren't able to do it on the day.

- Send out your invoices early - this will allow you and your client to have your accounts sorted before you close.

- Consider your expenses: Planning a Christmas function for your staff? Sending out client gifts? You can claim these as business expenses. You can claim half of the cost of any items that are food, drink or entertainment-related in your income tax return.

-

Plan your 2022 goals: Your review of 2021 goals will give you a good insight into your next steps heading into 2022, so now is the time to write them down.

One Final Note:

Take care of yourself! We understand that this can be a busy time of the year for many. But, with a bit of planning underway, you should be able to ease into 2022 smoothly, allowing yourself a bit of extra time to enjoy the holiday season.

|

|

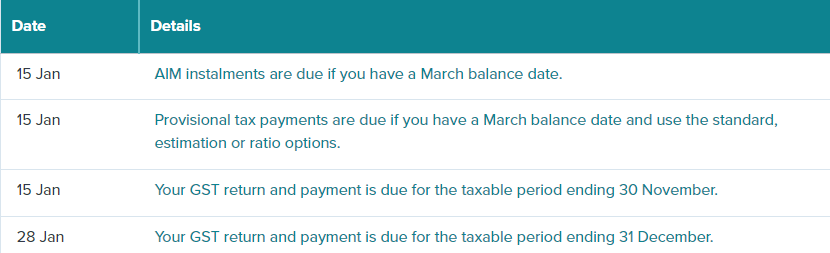

IRD UPCOMING TAX PAYMENT DATES

|

|

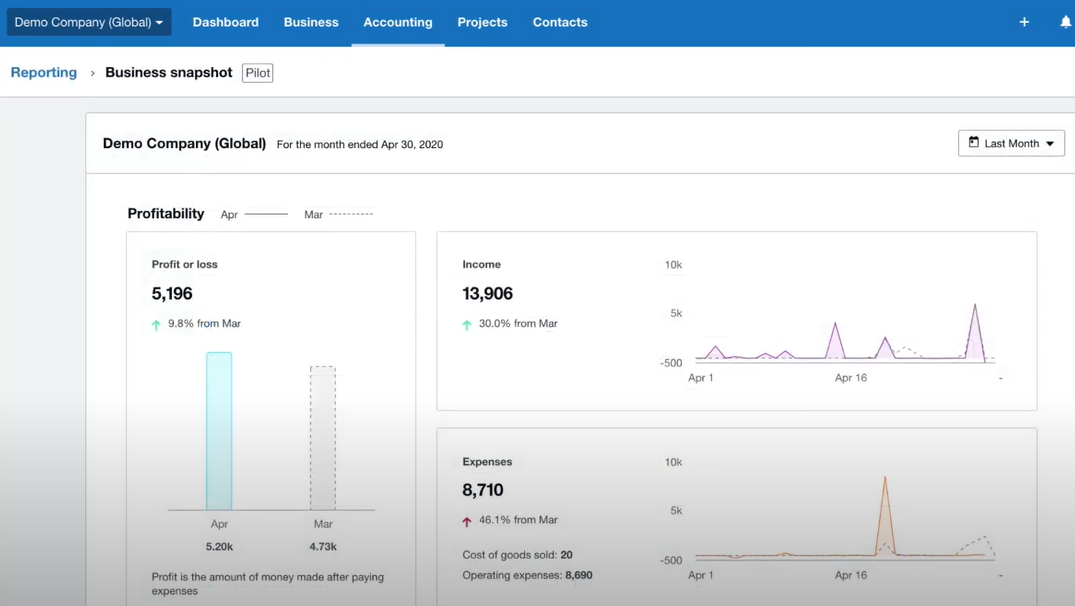

XERO TIP OF THE MONTH - BUSINESS SNAP SHOT FEATURE & ANALYTICS PLUS

Want to see a Business Snapshot of how your entity was tracking over the last 12 months – all on one page? Well, you can! With Xero's Business Snapshot!

Business snapshot is a dashboard that shows you valuable financial information, such as profitability, income and expenses, plus much more allowing you to view your financial wellbeing and identify trends in a single snapshot!

How to access Business Snapshot:

- In the Business menu, select Business snapshot

- To change the dashboard's reporting period, click Year to date. The text on the button changes to show the selected reporting period.

- You can change the reporting basis from accrual to cash basis by clicking on Accrual in the top right-hand corner.

- To print the snapshot, click Print. You can save the snapshot as a PDF when you're in the print preview.

|

|

To access extra features in Business Snapshot, upgrade to Analytics Plus!

Business Snapshot in Analytics Plus gives you a better insight into valuable school finances, such as cash flow, profitability and plenty more...

Business snapshot in Analytics Plus lets you:

- Use custom date ranges beyond the last month, quarter, financial year or year to date.

- Choose which accounts are included in the dashboard's calculations.

- Choose which expenses to track on the expenses table

- Drill down into a metric on the dashboard to see the underlying transactions.

If you are on a starter, standard or premium plan, you can try Analytics Plus for FREE until 31 January 2022. Once the free period has ended, the standard pricing will apply.

To access more information, including a short video on Analytics Plus,

Click the button below.

|

|

WELCOME TO THE TEAM: KELLY & NERISSA

Kelly Zheng

Originally from China, Kelly has been in New Zealand for more than seven years and is currently studying towards her BCom at Victoria University while also undertaking an ACCA qualification.

Kelly has joined the AAF team as our summer intern, providing the team with extra support to service our clients over the busy season.

Kelly is looking forward to applying her existing skills and knowledge into practice. She is excited to help us provide and maintain excellent service standards for our clients.

In Kelly's spare time, she enjoys cooking for friends, swimming and table tennis.

Nerissa Heyrana

Born and raised in the Philippines, Nerissa moved to New Zealand two years ago, where she graduated from Auckland University with a graduate diploma in Accounting.

As our new Business Services Accountant, Nerissa will be assisting our clients with their financial records by providing internal and external reports.

Nerissa is looking forward to utilizing her skills and experience while providing and maintaining excellent service to our clients.

In Nerissa's spare time, she enjoys exploring the city of Wellington (having just moved here recently) and going on treks in the hills and mountains!

|

|

QUESTION OF THE MONTH:

QUESTION: Are Partners counted as "one group of persons" for grouping tax losses?

Company A is going to make a loss in the 2022 year while Company B is going to make a profit. Company A would like to offset its loss against the profit of Company B for the 2022 tax year. Both companies are standard companies.

Company A is owned 50% by Partner 1 and 50% by Partner 2. Company B is owned 95% by the Partner 1 and 5% by Partner 2. For Company A to offset its loss against the profit in Company B, at least 66% of the voting shares in both companies must be held by "a group of persons".

Does Partner 1 and Partner 2 constitute "a group of persons” or are they counted as separate shareholders for the purposes of the commonality of shareholding test?

ANSWER:

Two or more companies are part of a group of companies where there is a group of persons that hold:

-

common voting interests that add up to at least 66%; and

-

when a "market value circumstance" exists in respect of any company, the “common market value interests” adds up to at least 66%.

See Income Tax Act 2007, ss IC 3, YC 2... Effectively the two companies must have common ownership at least 66%.

For the purposes of determining common voting interests for a group of companies, Partners are not treated as one person and therefore the lowest common interest in this situation will be 55%. As this is less than 66%, this is insufficient for Company A to offset its loss against Company B's net income.

We note this differs from the position in the associated persons tests, where the voting interests of Partners are aggregated to determine if association exists.

|

|

NEW PREMISES IN 2022!

Exciting things are happening here at All Accounted For, and we want to share some important news.

Continued support from clients has made the move to a new premises necessary, in order to accommodate our amazing team of 19. We are moving all of 10 metres, staying in the same building here at 271 Willis Street.

There'll also be a surprise that all our clients will be able to enjoy. Stay tuned for photos and updates in the new year!