|

|

September 2021

Keep up-to-date with us and what's happening in the education sector

- A Big Thank You

- 2022 Provisional Notices & Annual Budget

- Covid-19 Regional Support Scheme 2021

- Xero Tip of the Month - Invoice reminders

- GST on Fundraising

- Educator Wellbeing : Small Steps

|

|

The Accounting For Schools team would like to acknowledge and thank you and your school for the fantastic efforts managing, adapting and ensuring education continued during the COVID-19 lockdowns. Your hard work has not gone unnoticed, and we appreciate all the hard work put in at the and continues to be delivered.

For Auckland schools that are still in L3, hang in there; we are all thinking of you and, we want to remind you that we are still here to offer our help, support and guidance in whatever way we can.

Kia Kaha, New Zealand

Ben, Allison and the Accounting For Schools team

|

|

2022 PROVISIONAL NOTICES & ANNUAL BUDGET

The provisional staffing and funding notices for 2022 are now available in the School Data Portal. Please download and then upload to the "2022 Accts / Budget" folder in Google Drive.

We have prepared the 2022 Budget Template reports for the majority of our regular monthly Schools, so these are now available in Google Drive, within the "2022 Accts / Budget" folder.

If you are not one of the schools we generally assist around the budget, but would like us to prepare a Budget Template report for your School, please contact Allison Henderson via admin@afsl.nz.

|

|

REMINDER: COVID-19 REGIONAL SUPPORT SCHEME 2021

This is a reminder that the government is offering you the COVID-19 Alert Level 3 Regional Support Scheme if you have incurred repeated costs in 2021 due to the recent regional Alert Level 3 restrictions.

To receive funding your school must meet the following eligibility criteria:

- The cost must have been incurred during a regional Alert Level 3 restriction.

- Evidence must be provided of this cost.

- Evidence must be provided confirming that this cost has been incurred a second time after the alert level restrictions.

Applications are assessed on a case-by-case basis and eligibility cannot be confirmed prior to an application being submitted.

For further assistance or to apply for this funding, please contact the resourcing team at resourcing@education.govt.nz or 04 463 8383.

|

|

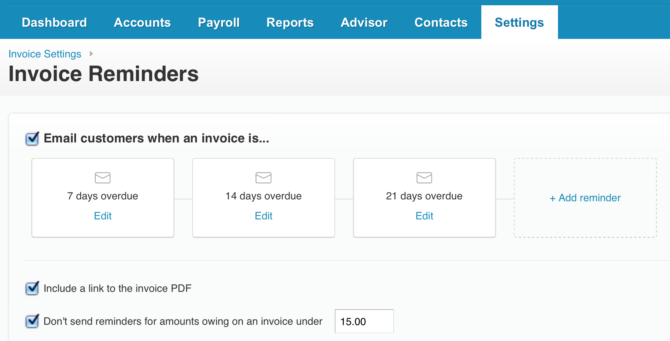

XERO TIP OF THE MONTH - INVOICE REMINDERS

Why worry about chasing up accounts receivable? Xero will do it for you!

All you have to do is set up the initial reminders and Xero will automatically send them depending on how far an invoice is past its due date.

Go to Settings, then General Settings, then Invoice Settings, where you’ll see the Invoice Reminders button. Choose from the predetermined days past due parameters or create your own reminder.

You can customize what each reminder email says; do this through the Edit link.

Additionally, Xero lets you include a link to the invoice in the reminder email as well as an option to not send reminders for outstanding invoices under a certain amount. If you choose, you can turn off reminders for a particular customer or invoice.

|

|

GST ON FUNDRAISING

As there are a number of different fundraising activities carried out by schools, the GST treatment for these will differ depending on the nature of the activity or event.

As a general rule, if the donor is not receiving anything in return for their contribution, it is considered a donation, and no GST is payable.

Examples of this include:

- Run-athons,

- Spell-athons or

- Donations towards a new bike track.

However, if the donor receives a good or service in return for their contribution, the income will likely be subject to GST.

Examples of this include:

- Sausage sizzles;

- Discos, sponsorship; and

- Purchase of raffle tickets (the purchaser is still acquiring the chance to receive something and, therefore, be subject to GST).

One exception to the rule is the sale or provision of donated goods/services which falls into a separate category and is exempt from GST. For example, if you are holding a bake sale, and all of the cakes have been donated, then the income raised is exempt from GST, even though the purchasers receive a good in return.

Should you have any questions on the GST treatment of fundraising, please contact the Accounting For Schools team to discuss.

|

|

EDUCATOR WELLBEING: SMALL STEPS

From lesson planning, staff meetings to never-ending to-do lists, it's no surprise that educators often experience significant amounts of stress and pressure, sometimes leading to burnout. While stress is inevitable, it's essential to be aware of it and know what tools are available to help you develop resiliency.

Small Steps is a free digital toolbox developed by Te Hiringa Hauora (in partnership with Clearhead) to help Aotearoa manage stress, calm the mind, and lift moods to improve mental wellbeing creating a happier, healthier you.

|

|